Volatility is back, and at the very least, it's keeping investors on their toes- as they suddenly go looking for safe havens and stability. Dividend stocks are usually a good place to start.

But, the challenge doesn't stop with finding companies that “just pay dividends” - it also involves looking for those that can continue to pay through the bouts of volatility.

That's why, in this article, I went looking for companies featuring attributes such as strong stability and growth potential, all while providing dependable income today and tomorrow.

Among them, a few stand out for their stellar execution, growth, and record of rewarding shareholders, making them the kind of dividend stocks investors can genuinely rely on.

How I Came Up With The Following Stocks

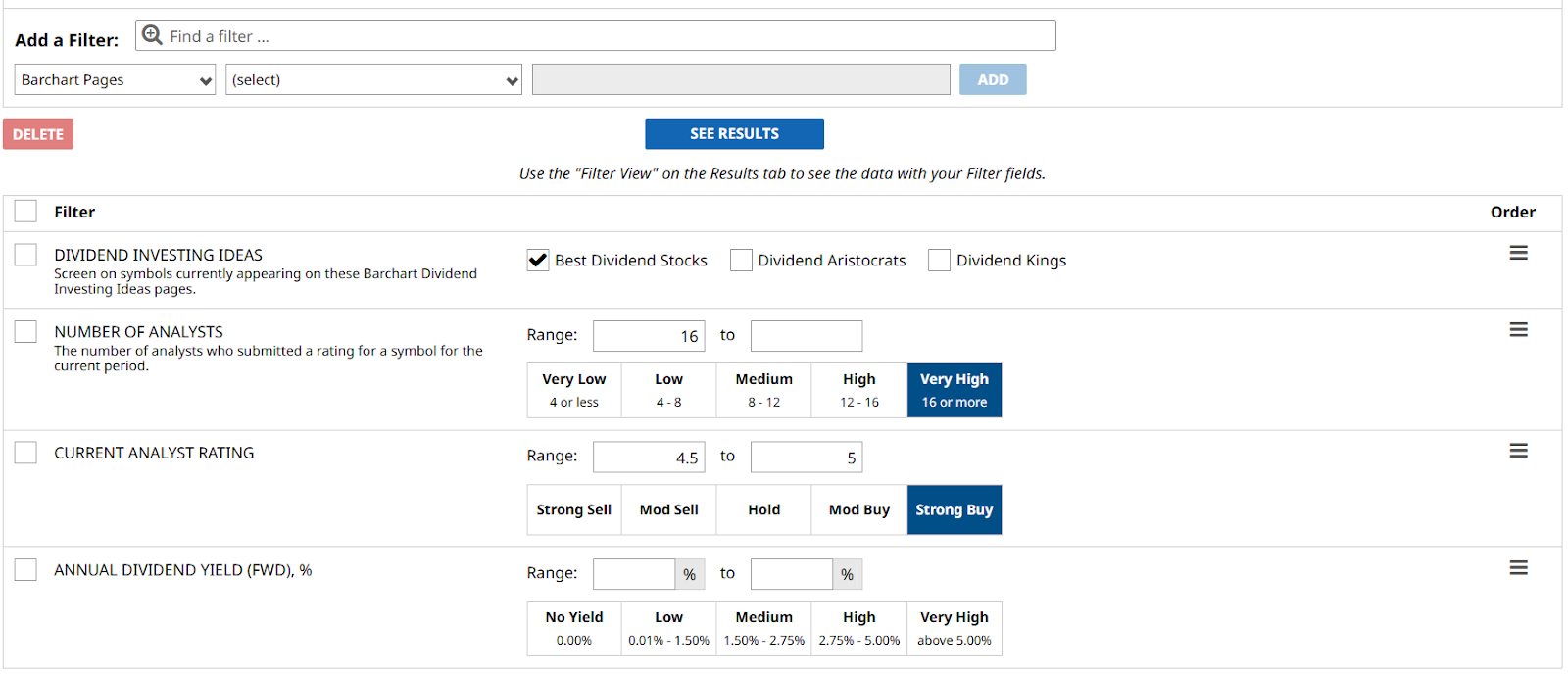

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- Dividend Investing Ideas: Best Dividend Stocks- pretty straightforward.

- Number of Analysts: 16 or more. I am looking for stocks that are known on Wall Street’s radar. The more analysts covering the stock, the higher the confidence in the sentiment.

- Current Analyst Rating: 4.5 or higher. These are stocks that analysts call a “Strong Buy.” Only the best of the best will do today.

- Annual Dividend Yield (FWD), %: Left blank. I will use this to sort the stocks from highest to lowest.

I got exactly five results after running the filters and will cover them based on their dividend yields, from highest to lowest.

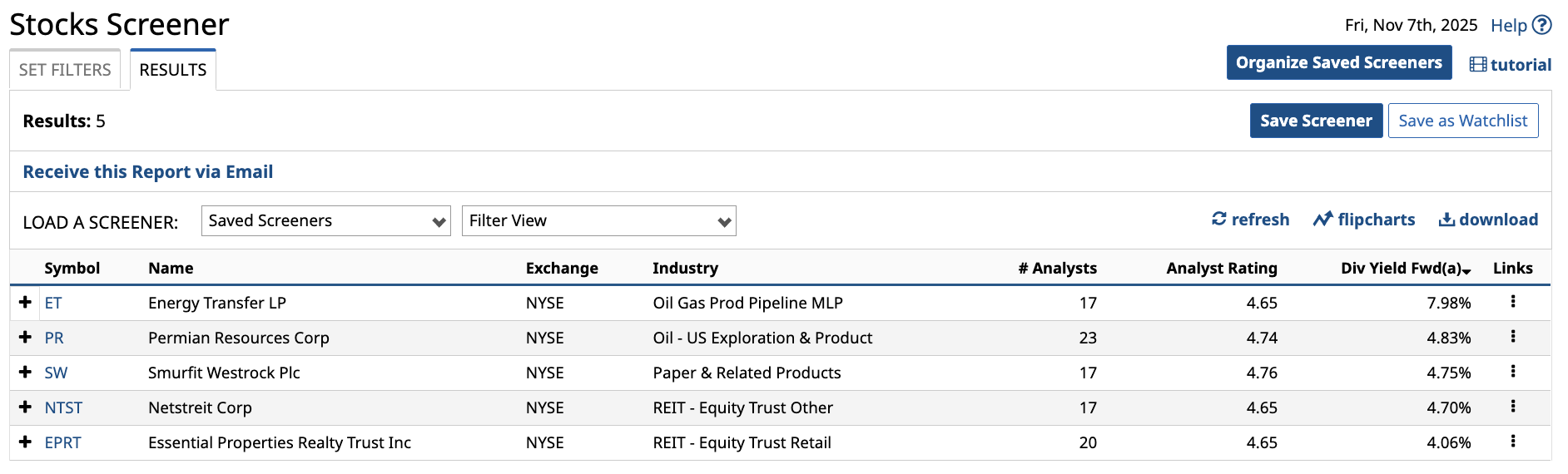

Let’s go over the highest yeilding dividend stock on the list:

Energy Transfer LP (ET)

Energy Transfer LP operates diversely in various parts of the energy supply chain, including the transportation, storage, and marketing of energy and related products, including natural gas and natural gas liquids. It was founded in 1996 and now owns over 125,000 miles of pipelines.

Recently, Entergy Louisiana and Energy Transfer LP signed a 20-year agreement that grants the company the right to deliver reliable natural gas to power facilities in North Louisiana, including Meta's upcoming data center in Richland Parish.

The company pays a forward annual dividend of $1.32, translating to a yield of approximately 8%, the highest among this list.

A consensus among 17 analysts rates the stock a “Strong Buy”, a rating consistent over the past three months, with a 48% potential upside based on its $25 high target price.

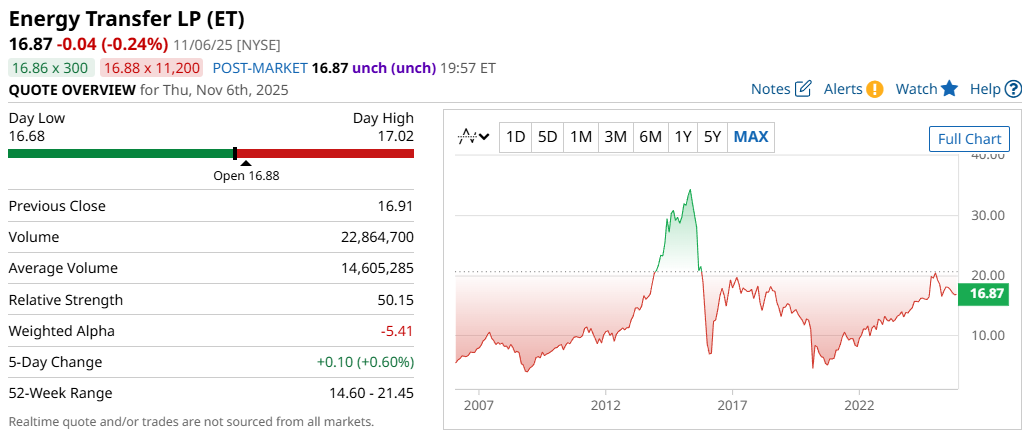

Permian Resources Corp (PR)

Another gas company in this list is Permian Resources Corp, which is developing reserves in the Permian Basin. The company was formed in 2022 after the merger of Centennial Resource Development and Colgate Energy. Today, it generates wide margins through the acquisition and development of oil- and liquid-rich natural gas assets.

Recently, Permian Resources reported an average of 410,000 barrels of oil equivalent per day in the third quarter, a record. Aside from that, they were also able to cut costs and expand their involvement in the Delaware Basin. That's a strong sign of growth and positive performance.

The company pays a forward annual dividend of $0.60, which translates to a yield of approximately 4.7%.

A consensus among 23 analysts rates the stock a “Strong Buy”, with as much as 71% upside potential based on its $22 high target price.

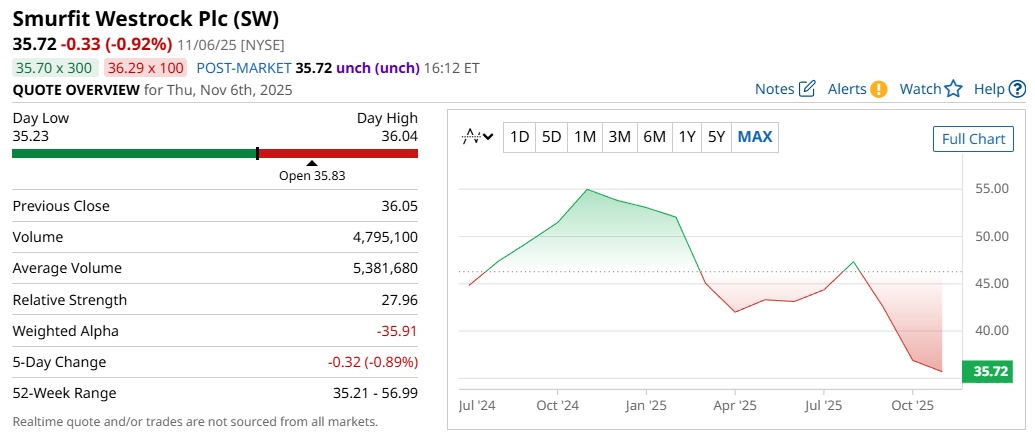

Smurfit Westrock Plc (SW)

The next dividend company on my list is Smurfit Westrock Plc. They are one of the world’s largest designers and manufacturers of sustainable paper and packaging solutions. The company was founded in 2024 after the merger of Smurfit Kappa and WestRock, and today, the company operates in 40 countries, employing over 100,000 workers and manufacturing more than 204.4 billion square feet of corrugated packaging in 2024.

Recently, Smurfit Westrock unveiled the world's first clinical packaging facility, located near Dublin Airport. The company invested over $46 million to support global clinical trials, including the staffing of 170 specialists.

The company pays a forward annual dividend of $1.72, translating to a yield of approximately 4.8% and a consensus among 16 analysts rates the stock a “Strong Buy”, with an upside potential of as much as 76% if the stock hits its high target price of $63.

Netstreit Corp (NTST)

The next company on my list is Netstreit, a self-managed real estate investment trust, or REIT, investing in single-tenant retail properties. Its focus is on businesses that are reliable and anchored on necessity, such as pharmacies and quick-service restaurants. The company was founded in 2019 and now has a portfolio of over 695 properties across 26 industries.

Recently, NetSTREIT secured $450 million in financing commitments and updated its existing crediting facilities to support growth. This was led by PNC Bank, expanding the scale of its portfolio of single-tenant, net-lease retail properties across the U.S.

The company pays 86 cents per share per year, translating to a yield of 4.70%. Meanwhile, a consensus among 17 analysts rates the stock a “Strong Buy”, with an upside potential of around 21% based on its high target price of $22.

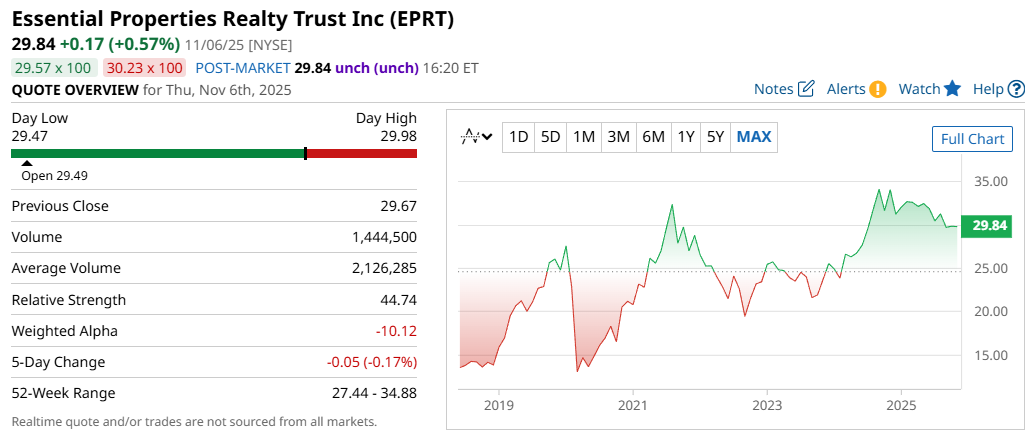

Essential Properties Realty Trust Inc. (EPRT)

The last dividend company on my list is Essential Properties Realty Trust Inc., another REIT that owns, acquires, and manages single-tenant lease properties. Similar to Netstreit, they focus on different service and experience-anchored sectors, including restaurants, car washes, and medical services. The company was founded in 2016 and now has a portfolio of over 500 properties across 42 states.

Recently, the company announced the pricing of $400 million in senior notes due 2035 at a competitive 5.4% interest rate, to be used for debt repayment and to strengthen future investments, which are anchored in expanding a stable portfolio of long-term, single-tenant properties here in the U.S.

Essential Properties pays a forward annual dividend of $1.20, which translates to a yield of approximately 4% and a consensus among 20 analysts rates the stock a “Strong Buy.

Final Thoughts

Like the tide, volatility comes and goes- but income helps investors sleep better at night when times are tough. The five dividend companies listed in this screen offer higher-than-average yields and lots of upside, making them attractive choices for any income portfolio. And don't forget, each of these companies has a “Strong Buy” rating from at least 16 analysts; this is no small feat. It means the companies have proven themselves to manage their business effectively while rewarding shareholders.

If you're looking for dependable income as we go into 2026, owning any of these companies to “pay you to wait” for other opportunities can make all the difference.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart