New York-based Nasdaq, Inc. (NDAQ) operates as a technology company that serves capital markets and other industries worldwide. Valued at $48.9 billion by market cap, the company provides trading, clearing, exchange technology, regulatory, securities listing, analysis, investing tools and guides, financial, and information services.

Shares of this leading global technology company have underperformed the broader market over the past year. NDAQ has gained 11.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.4%. In 2025, NDAQ stock is up 11.5%, compared to the SPX’s 14.3% rise on a YTD basis.

Narrowing the focus, NDAQ’s underperformance looks more pronounced compared to SPDR S&P Capital Markets ETF (KCE). The exchange-traded fund has gained about 1.7% over the past year. Moreover, NDAQ’s low double-digit gains on a YTD basis outshine the ETF’s 5.3% returns over the same time frame.

On Oct. 31, NDAQ shares closed down marginally after reporting its Q3 results. Its adjusted EPS of $0.88 surpassed Wall Street expectations of $0.84. The company’s net revenue was $1.32 billion, surpassing Wall Street forecasts of $1.29 billion.

For the current fiscal year, ending in December, analysts expect NDAQ’s EPS to grow 20.2% to $3.39 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

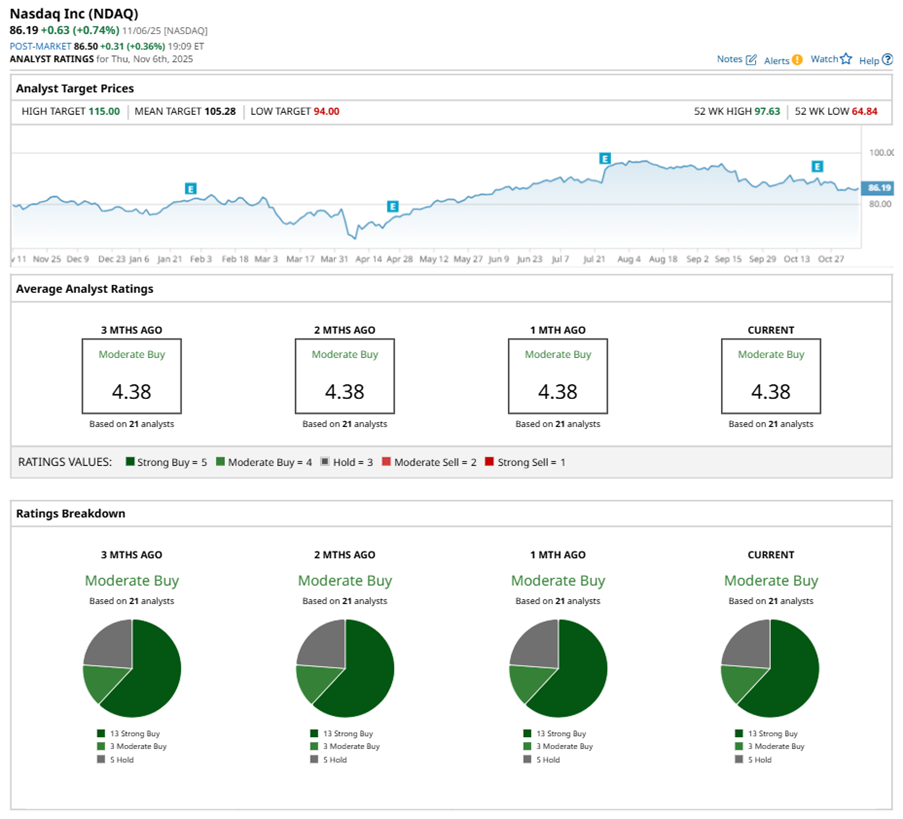

Among the 21 analysts covering NDAQ stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and five “Holds.”

The configuration has been consistent over the past three months.

On Oct. 23, Bank of America Corporation (BAC) kept a “Buy” rating on NDAQ and raised the price target to $111, implying a potential upside of 28.8% from current levels.

The mean price target of $105.28 represents a 22.1% premium to NDAQ’s current price levels. The Street-high price target of $115 suggests an ambitious upside potential of 33.4%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?