Birmingham, Alabama-based Regions Financial Corporation (RF) is a major regional bank offering retail and commercial banking, mortgage, and wealth-management services across the Southern and Midwestern U.S. Valued at a market cap of $21.6 billion, the company provides retail, commercial, and mortgage banking, as well as asset management, wealth management, securities brokerage, trust services, and mergers and acquisitions advisory services.

This regional bank has trailed the broader market over the past 52 weeks. Shares of RF have surged 3.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.5%. On a YTD basis, the stock is up 2.7%, lagging SPX’s 15.1% gains.

However, RF has outperformed the industry-specific iShares U.S. Regional Banks ETF’s (IAT) 1% rise over the past 52 weeks and 2.1% drop on a YTD basis.

On Oct. 20, RF’s shares popped 2% after the company launched enhanced Treasury Management services for healthcare clients, aimed at automating and streamlining the full payments process. Powered by MediStreams, the new Healthcare Receivables Services help automate remittance workflows, accelerate payment reconciliation, and integrate seamlessly with a wide range of accounting systems to support faster, more efficient financial operations.

Additionally, Regions Financial posted fiscal 2025 third-quarter earnings on Oct. 17, and its shares jumped 2%. Its adjusted earnings stood at $0.63 per share, supported by a 7% increase in net revenue to $1.9 billion. Fee-based businesses, including wealth management and capital markets, hit record results, helping offset pressure on net interest income and a slightly lower net interest margin.

For the current fiscal year, ending in December, analysts expect RF’s EPS to grow 10.9% year over year to $2.35. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

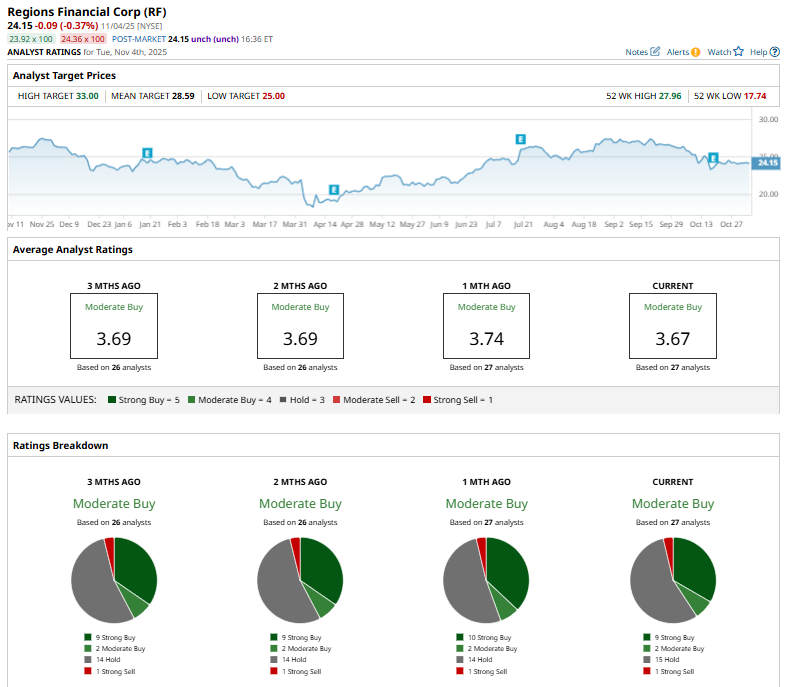

Among the 27 analysts covering the stock, the consensus rating is a "Moderate Buy” which is based on nine “Strong Buy,” two "Moderate Buy,” 15 “Hold,” and one “Strong Sell” rating.

This configuration is slightly bearish than a month ago, with 10 analysts suggesting a “Strong Buy” rating.

On Oct. 4, Wells Fargo reiterated its “Hold” rating on Regions Financial and set a $27 price target.

The mean price target of $28.59 represents an 18.4% premium from RF’s current price levels, while the Street-high price target of $33 suggests an upside potential of 36.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Volatility Alert: 10 Stocks Showing High IV Percentile

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?