Kenvue (KVUE) shares are up roughly 15% at writing after Irving, Texas-headquartered Kimberly-Clark (KMB) said it will buy the consumer health company in a deal that values it at $48.7 billion.

Kenvue shareholders will receive $3.50 per share in cash and the remainder in KMB stock. The deal will unlock synergies worth $2.1 billion in total, according to the companies’ joint press release on Monday.

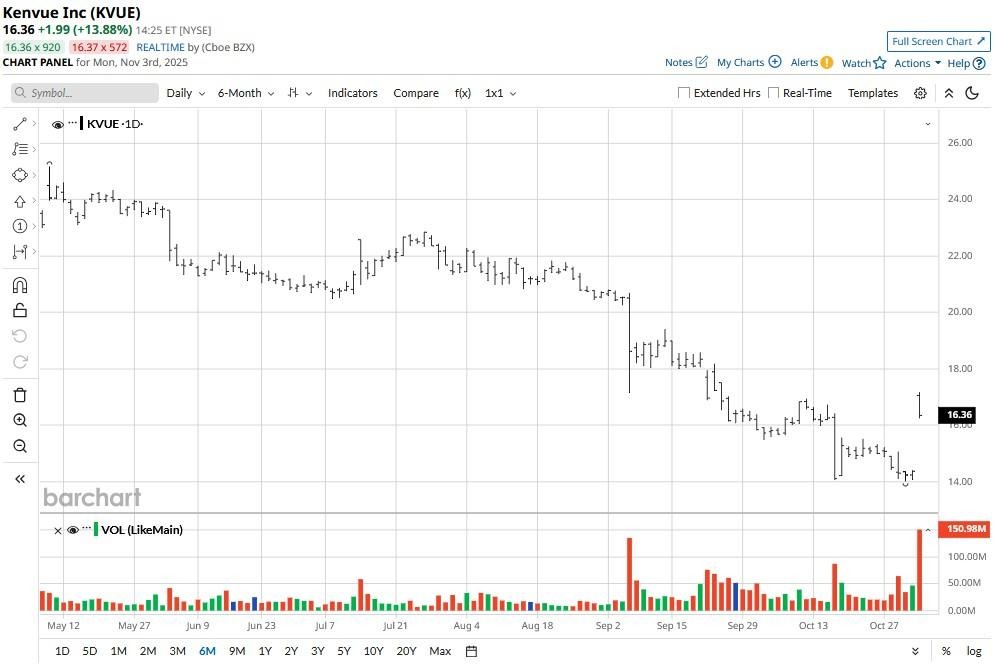

Despite today’s surge, Kenvue stock is down well over 30% versus its year-to-date high set in May.

Why Is the KMB Deal Bullish for Kenvue Stock?

The Kimberly-Clark agreement is a major win for KVUE stock because it values the NYSE-listed firm at an exciting 50% premium.

The $3.50-per-share cash payout offers immediate liquidity to the company’s investors, while the KMB stock component gives them exposure to a blue-chip dividend payer with global scale.

Additionally, the $2.1 billion in expected run-rate synergies indicate operational upside and margin expansion potential.

Simply put, the transaction validates Kenvue’s strategic value while positioning it to benefit from Kimberly-Clark’s distribution muscle as well. It’s a rare blend of short-term reward and long-term upside.

Jim Cramer Recommends Owning KVUE Shares

Famed investor Jim Cramer sees Kimberly-Clark transaction as meaningfully positive for KVUE shares as “where KMB is strong, they’re not (China) – and where they are strong, Kimberly is not (Europe).”

According to him, the Tylenol-related litigation risks are largely overblown. In fact, “this stock – if it weren’t for RFK – would be at $22,” he argued in a segment of CNBC this morning.

Kenvue shares are currently trading about 25% below that price, suggesting the Mad Money host believes they’re going for a meaningful discount at the time of writing.

The consumer health company currently pays a rather lucrative dividend yield of 5.1% as well, which makes up for another strong reason to own it heading into 2026.

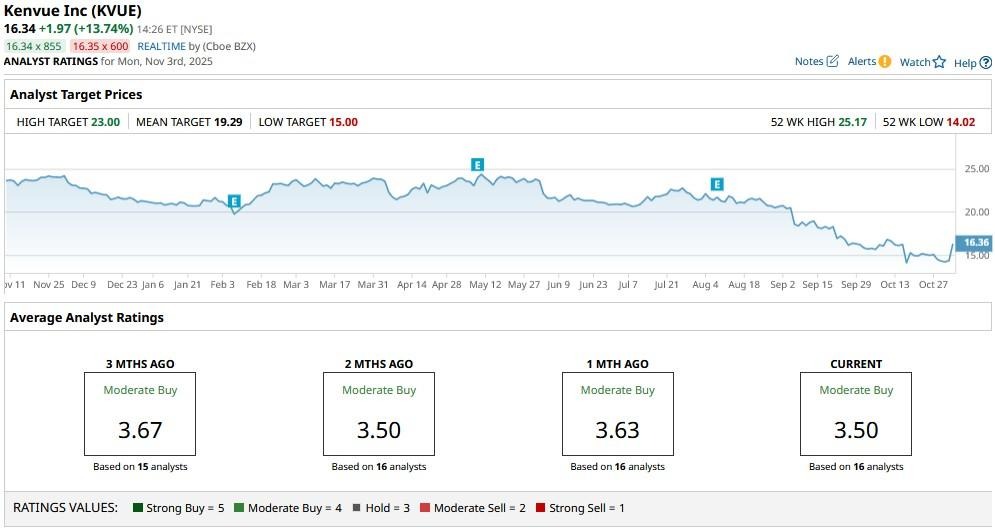

Wall Street Has a ‘Buy’ Rating on Kenvue

Wall Street analysts also agree with Cramer’s bullish view on Kenvue stock.

The consensus rating on KVUE shares currently sits at “Moderate Buy” with the mean target of $19.29 indicating potential upside of more than 15% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Future Is Now as This New Drone ETF Takes Flight

- Dear Kenvue Stock Fans, Mark Your Calendars for November 6 Upcoming earnings

- Amazon Is Giving Marvell Technologies Stock a Huge Boost. Why, and Should You Buy MRVL Here?

- The QQQ ETF Could Gain 30% From Here, But It’s Also Waving a Giant, Dot-Com Era Red Flag