Framingham, Massachusetts-based The TJX Companies, Inc. (TJX) operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. With a market cap of approximately $156 billion, TJX Companies operates through Marmaxx, HomeGoods, TJX Canada, and TJX International segments.

The fashion retailer has marginally lagged behind the broader market in 2025, while notably outperformed over the past year. TJX stock prices have gained 16% on a YTD basis and soared 24.1% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

Narrowing the focus, TJX has also outperformed the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.9% uptick in 2025 and 20% surge over the past 52 weeks.

TJX Companies’ stock prices gained 2.7% in the trading session following the release of its impressive Q2 results on Aug. 20. The quarter was marked with solid 4% comparable sales growth and improved efficiency, leading to expansion in margins. TJX’s topline came in at $14.4 billion, up 6.9% year-over-year and 2.3% above the Street’s expectations. Further, driven by expansion in gross margin and a slight drop in SG&A expenses as a percentage of topline, the company’s net income surged 13.1% year-over-year to $1.2 billion, and its EPS of $1.10 surpassed the consensus estimates by 8.9%.

For the full fiscal 2026, ending in January, analysts expect TJX to deliver an EPS of $4.64, up 8.9% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

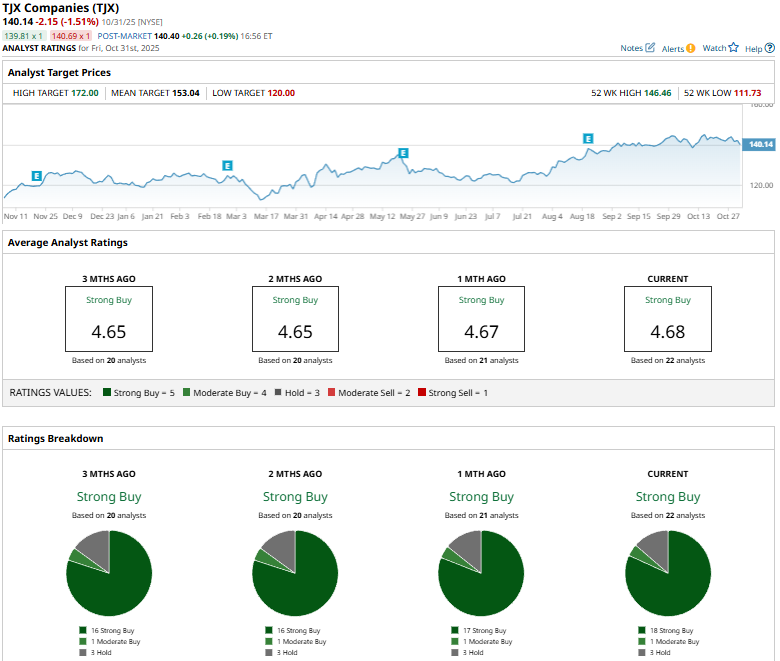

Among the 22 analysts covering the TJX stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buys,” one “Moderate Buy,” and three “Holds.”

This configuration is slightly more optimistic than a month ago, when 17 analysts gave “Strong Buy” recommendations.

On Oct. 27, Wells Fargo (WFC) analyst Ike Boruchow maintained an “Equal-Weight” rating on TJX, while raising the price target from $130 to $140.

TJX’s mean price target of $153.04 suggests a 9.2% upside potential. Meanwhile, the street-high target of $172 represents a notable 22.7% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart