Cadre has been treading water for the past six months, recording a small return of 4.3% while holding steady at $33.36.

Given the underwhelming price action, is now a good time to buy CDRE? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does CDRE Stock Spark Debate?

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Two Positive Attributes:

1. Long-Term Revenue Growth Shows Momentum

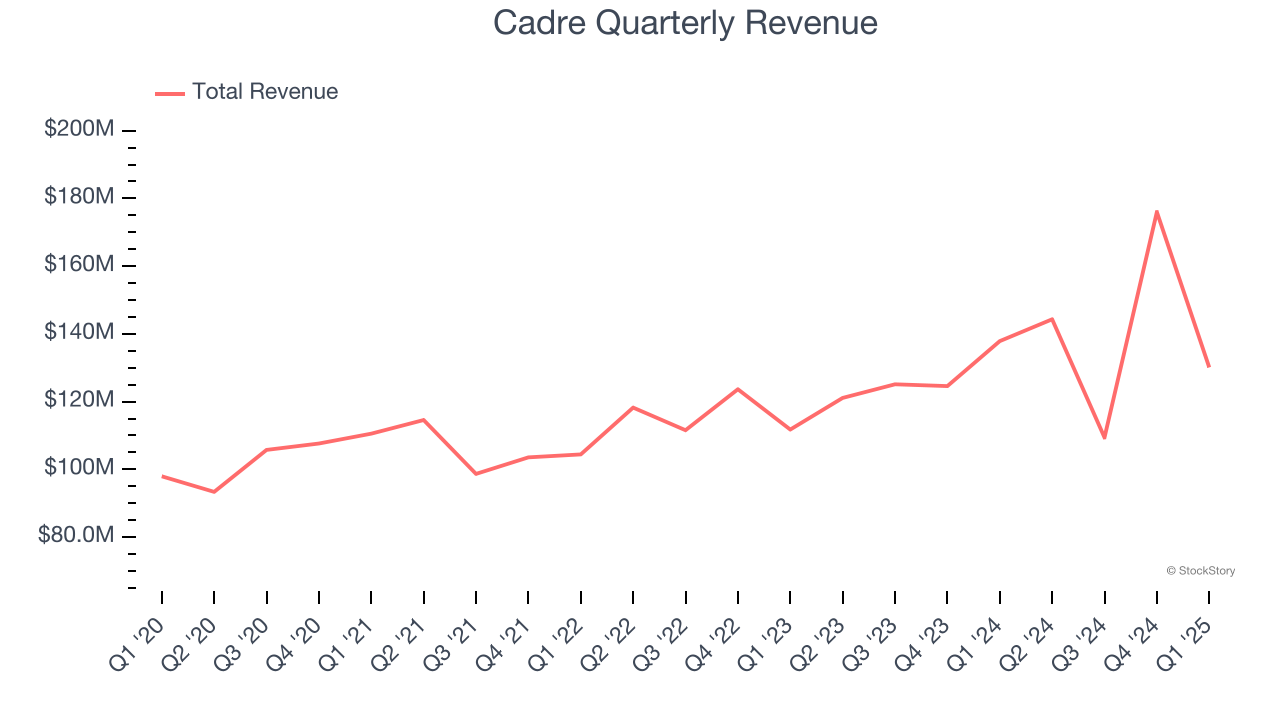

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Cadre’s sales grew at a decent 7.6% compounded annual growth rate over the last four years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

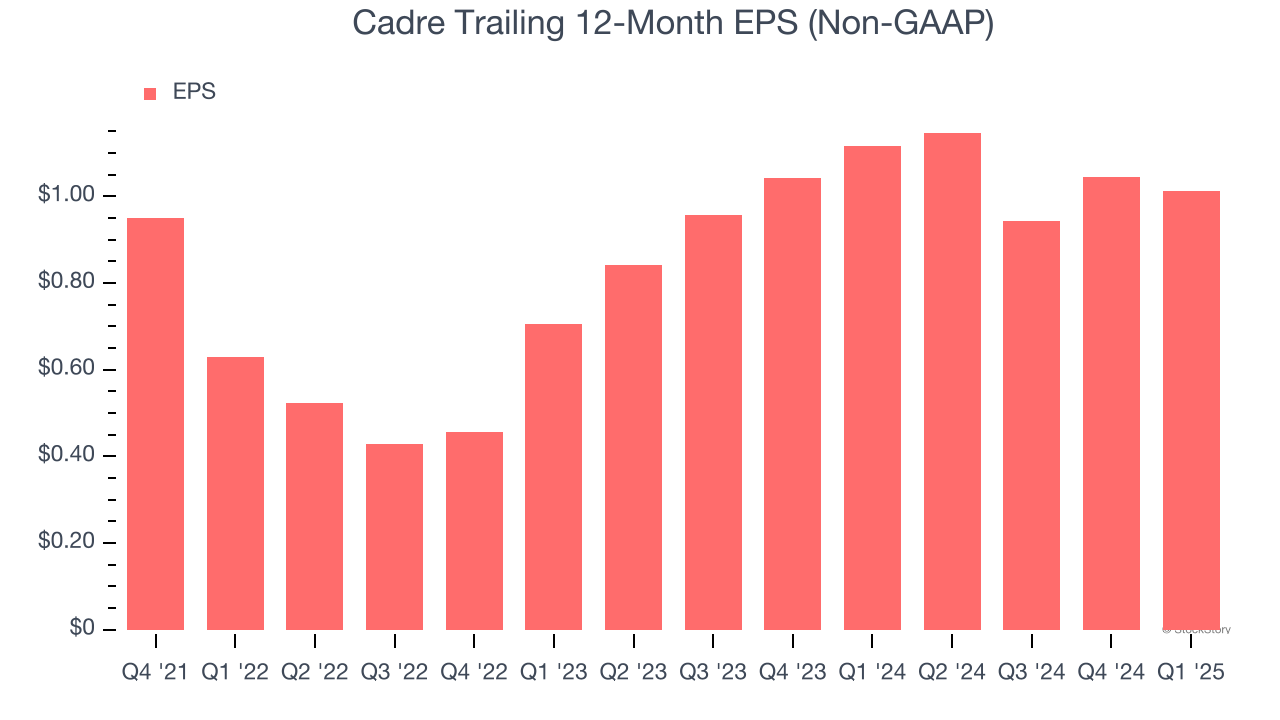

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Cadre’s full-year EPS grew at a spectacular 17.2% compounded annual growth rate over the last three years, better than the broader industrials sector.

One Reason to be Careful:

Free Cash Flow Margin Dropping

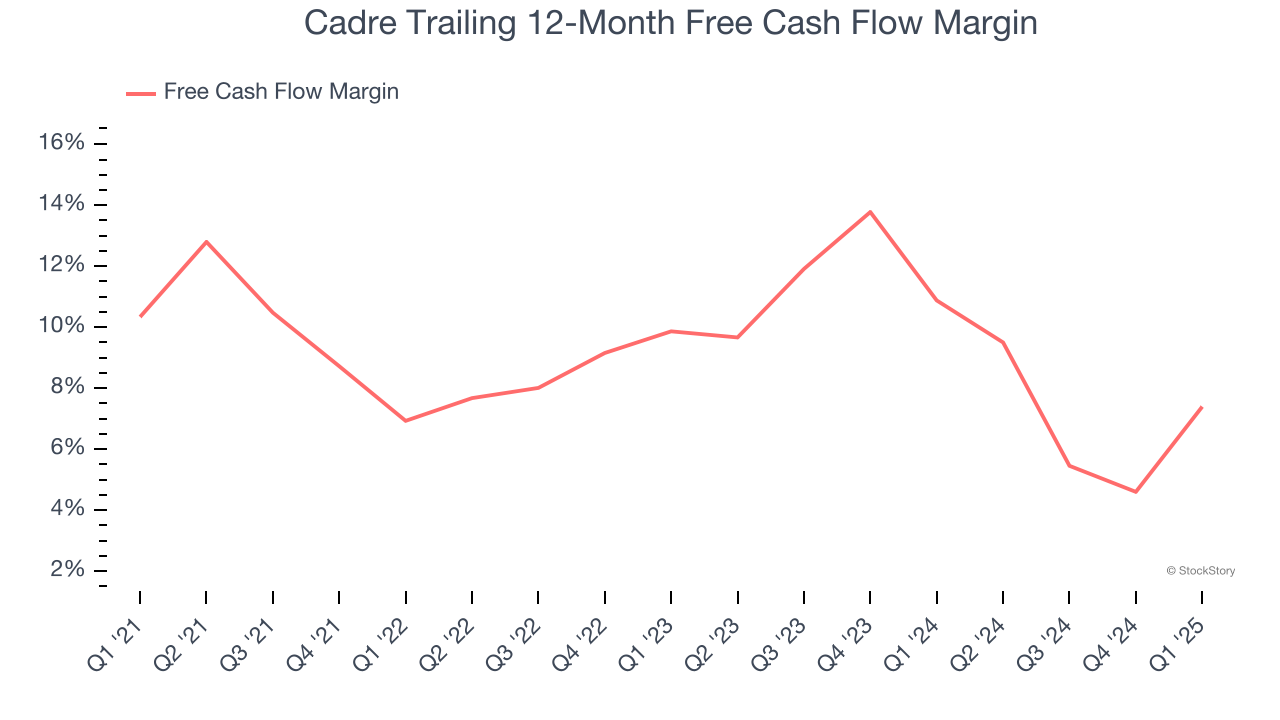

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Cadre’s margin dropped by 2.9 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. Cadre’s free cash flow margin for the trailing 12 months was 7.4%.

Final Judgment

Cadre’s positive characteristics outweigh the negatives, but at $33.36 per share (or 20.6× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Cadre

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.