Workday, Inc. (WDAY) offers enterprise cloud applications that help its customers execute, analyze, and extend to other applications and environments and manage businesses and operations. The company serves professional and business services, financial services, healthcare, education, government, technology, retail, and hospitality industries.

WDAY reported its third-quarter results (which ended October 31) this week. Underscoring robust demand, the company’s total revenues increased 16.7% year-over-year to $1.87 billion. Non-GAAP net income per share came in at $1.53, compared to $0.99 in the prior-year period.

In light of these conducive trends, let’s look at the trends of key financial metrics to understand why WDAY could be a solid buy now.

Analyzing Workday's Financial Trajectory: Substantial Variances from 2021 to 2023

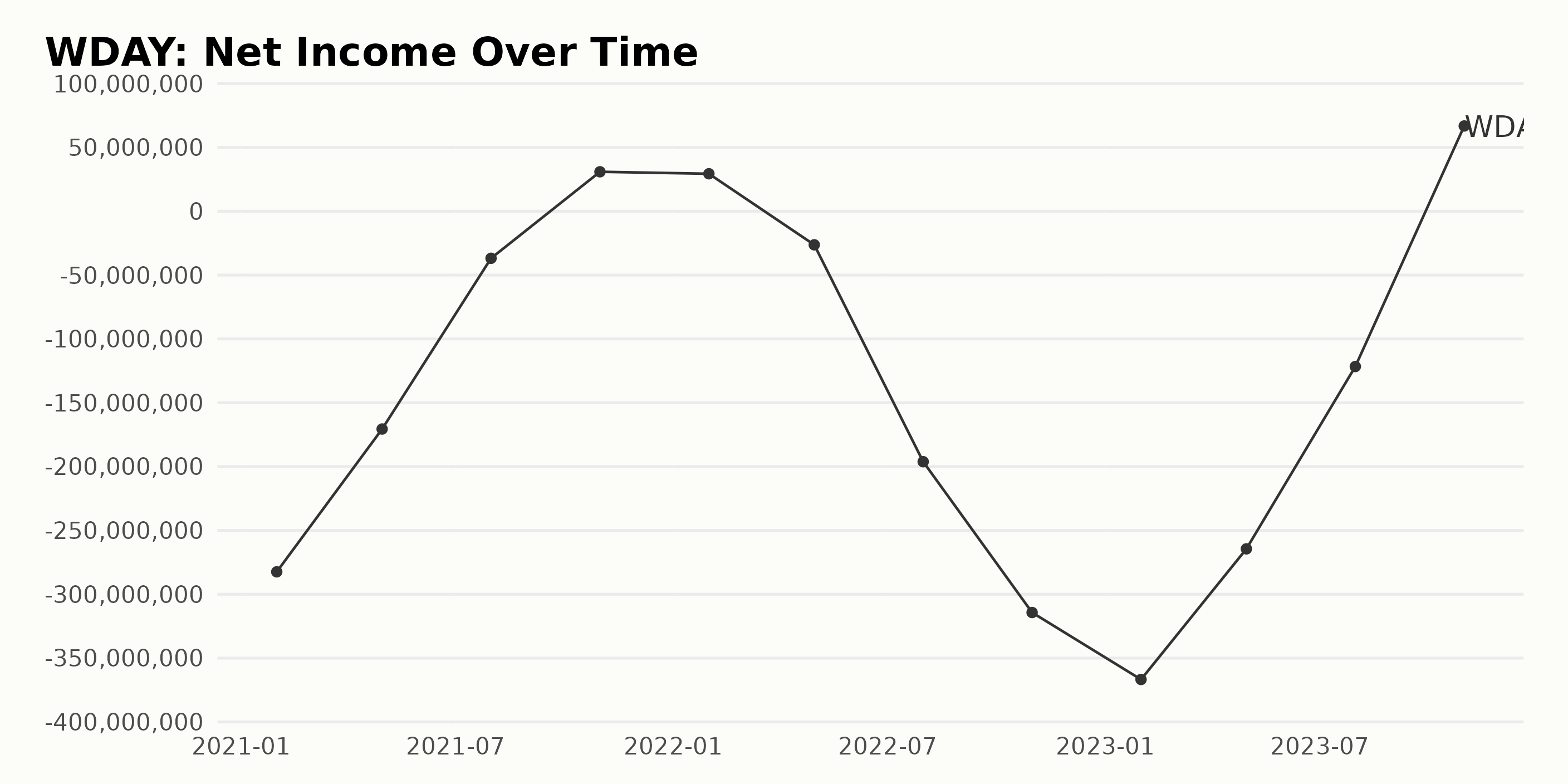

The trailing-12-month net income trend for WDAY from January 2021 to October 2023 reveals significant fluctuations.

- In January 2021, the net income was a loss of $282.43 million.

- A decrease in loss was observed by April 2021 with a net income of -$170.58 million.

- This improving trend continued to July 2021, which recorded a lower loss of $36.83 million, before turning to profit territory in October 2021 at $30.92 million and January 2022 at $29.37 million.

- A setback occurred in April and July 2022, with losses of $26.28 million and $196.17 million, respectively.

- A much steeper dive into a negative was seen by October 2022 with a loss of $314.31 million, which further deepened to $366.75 million in January 2023.

- Losses distinctly tapered down over the next two quarters, resulting in $264.44 million in April 2023 and $121.62 million in July 2023.

- Importantly, we finally observed a stark recovery in October 2023 ending on a positive note with a profit of $66.81 million.

Beginning with a loss of $282.43 million in January 2021 to having a net income of $66.81 million in October 2023, we derive a growth rate by comparing the first and last value in the series, which results in a substantial increase.

By emphasizing the more recent data, it's noteworthy that WDAY suffered significant losses beginning from mid-2022 but ended the period in observation with a promising recovery into profit by October 2023.

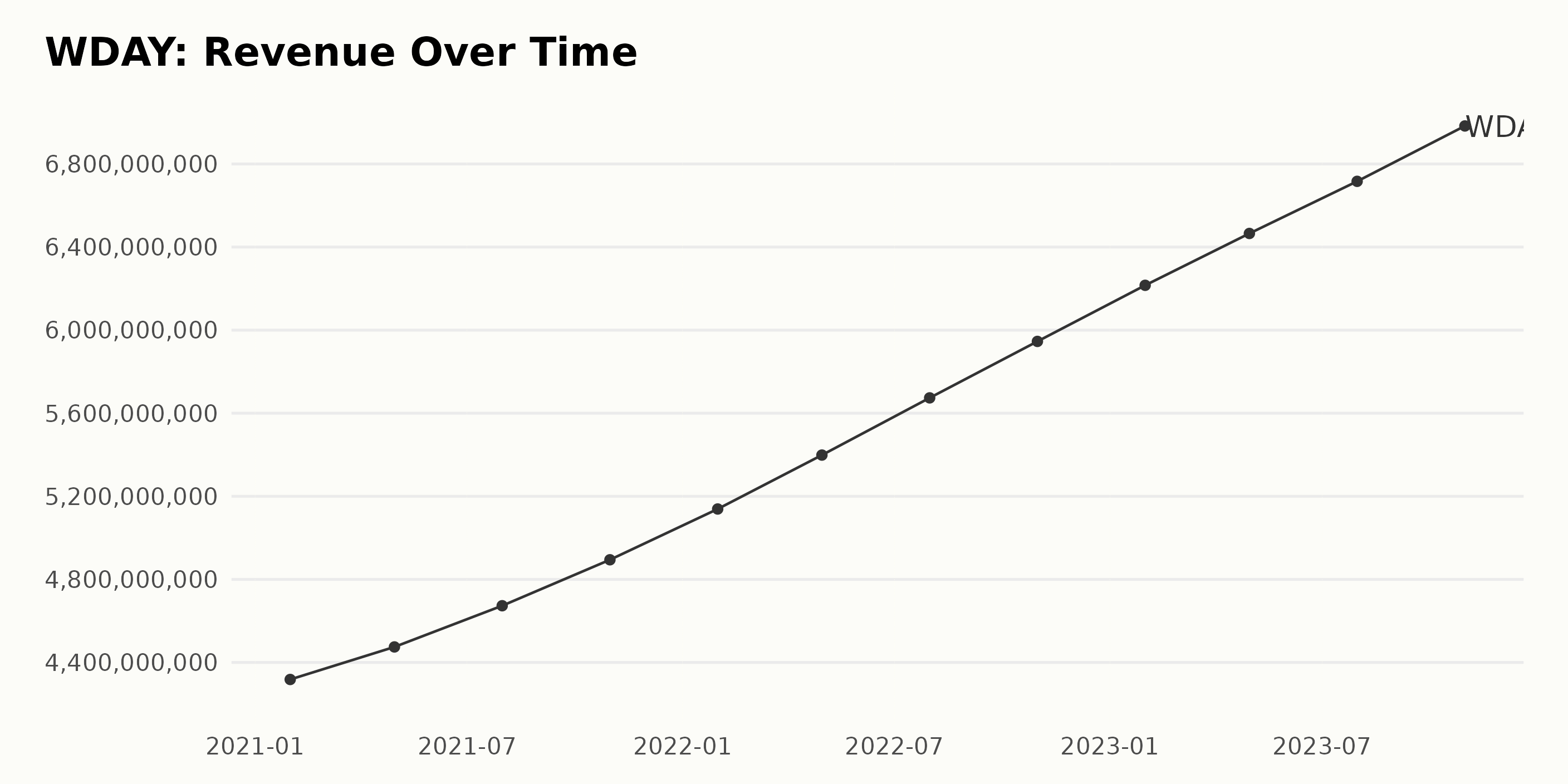

The trailing-12-month revenue of WDAY has experienced consistent growth over the observed period from January 2021 to October 2023.

Key Highlights:

- In January 2021, the revenue was $4.32 billion.

- Thereafter, it gradually increased on a quarterly basis, with some fluctuations in the rate of growth.

- The largest quarter-to-quarter increase in revenue occurred between the months of April 2022 and July 2022, when it jumped from $5.40 billion to $5.67 billion.

- The latest recorded revenue, as of October 2023, stands at $6.98 billion.

Briefly, this data set shows an upward trend for WDAY's revenue. From the first recorded value of $4.32 billion in January 2021 to the last recorded value of $6.98 billion in October 2023, the total growth rate comes to approximately 62%. This implies that the company's monetary inflow, via sales and other sources, is increasing substantially over time.

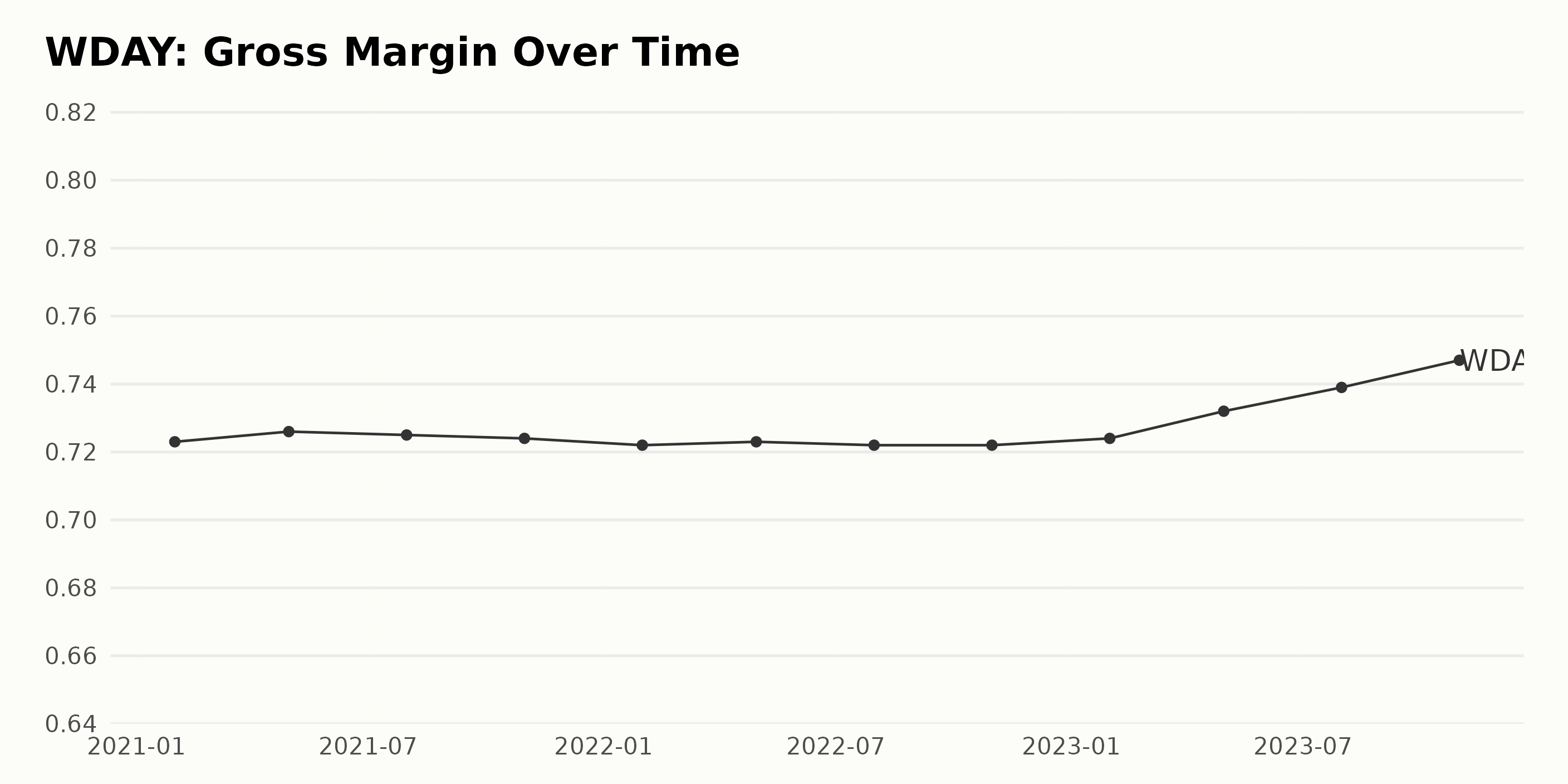

The gross margin of WDAY has seen minor fluctuations over the recent years since January 2021.

- January 2021 - 72.3%

- April 2021 - 72.6%

- July 2021 - 72.5%

- October 2021 - 72.4%

However, the year 2022 didn't show much progress as the gross margin fluctuated around 72.2% to 72.3%.

- January 2022 - 72.2%

- April 2022 - 72.3%

- July 2022 - 72.2%

- October 2022 - 72.2%

In 2023, there has been a more noticeable upward trend in the company's gross margin.

- January 2023 - 72.4%

- April 2023 - 73.2%

- July 2023 - 73.9%

- October 2023 - 74.7%

As of the last reported value in October 2023, the gross margin is 74.7%. Therefore, since January 2021, a growth rate of approximately 3.32% has been seen. This reflects a positive upward trend and improvement in WDAY's profitability.

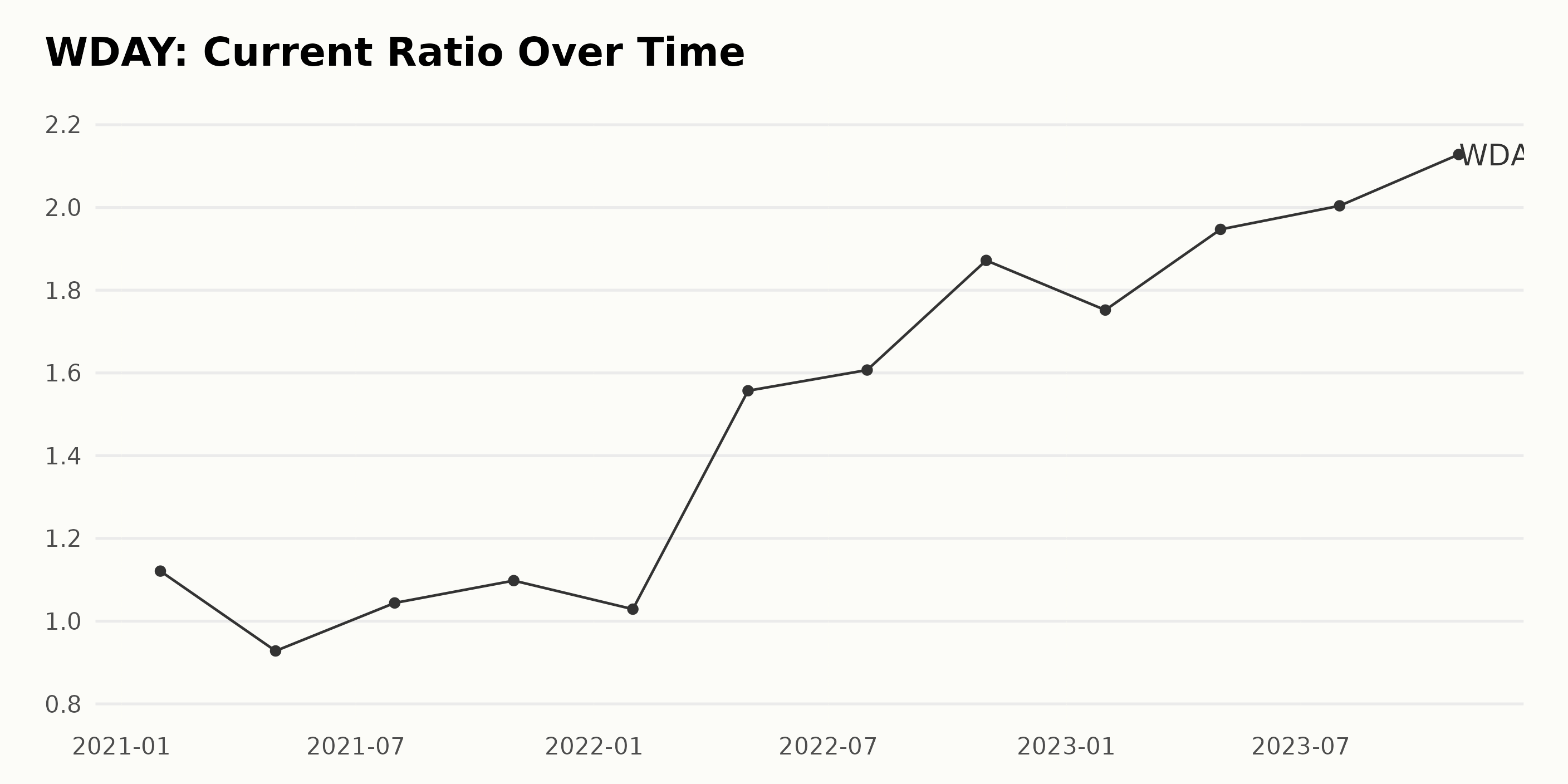

Here's a summary of the trend and fluctuations in the current ratio for WDAY:

- On January 31, 2021, the current ratio was at 1.12. Over the course of the year, there were fluctuations notably: a dip to 0.93 on April 30, 2021, and a peak at 1.61 on July 31, 2022. However, the data suggests an overall increasing trend across the series. Important to note that the more recent data reflects a steeper incline despite minor dips.

- The current ratio escalated rapidly from 1.75 in January 2023 to 2.13 by October 2023. The absolute last value recorded was 2.13 on October 31, 2023, indicating that WDAY had $2.13 of current assets for every $1 of current liabilities.

- In terms of growth rate, the current ratio initially grew from 1.12 in January 2021 to 1.87 in October 2022, suggesting a growth rate of approximately 67%. The growth continued from 1.75 in January 2023 to 2.13 in October 2023, which indicates a growth rate of around 21% over the period.

In conclusion, the current ratio of WDAY has demonstrated sizeable growth over the given period, with a noticeable acceleration in more recent times. The latest figures suggest improved financial health of the company as it appears better equipped to pay off its short-term liabilities.

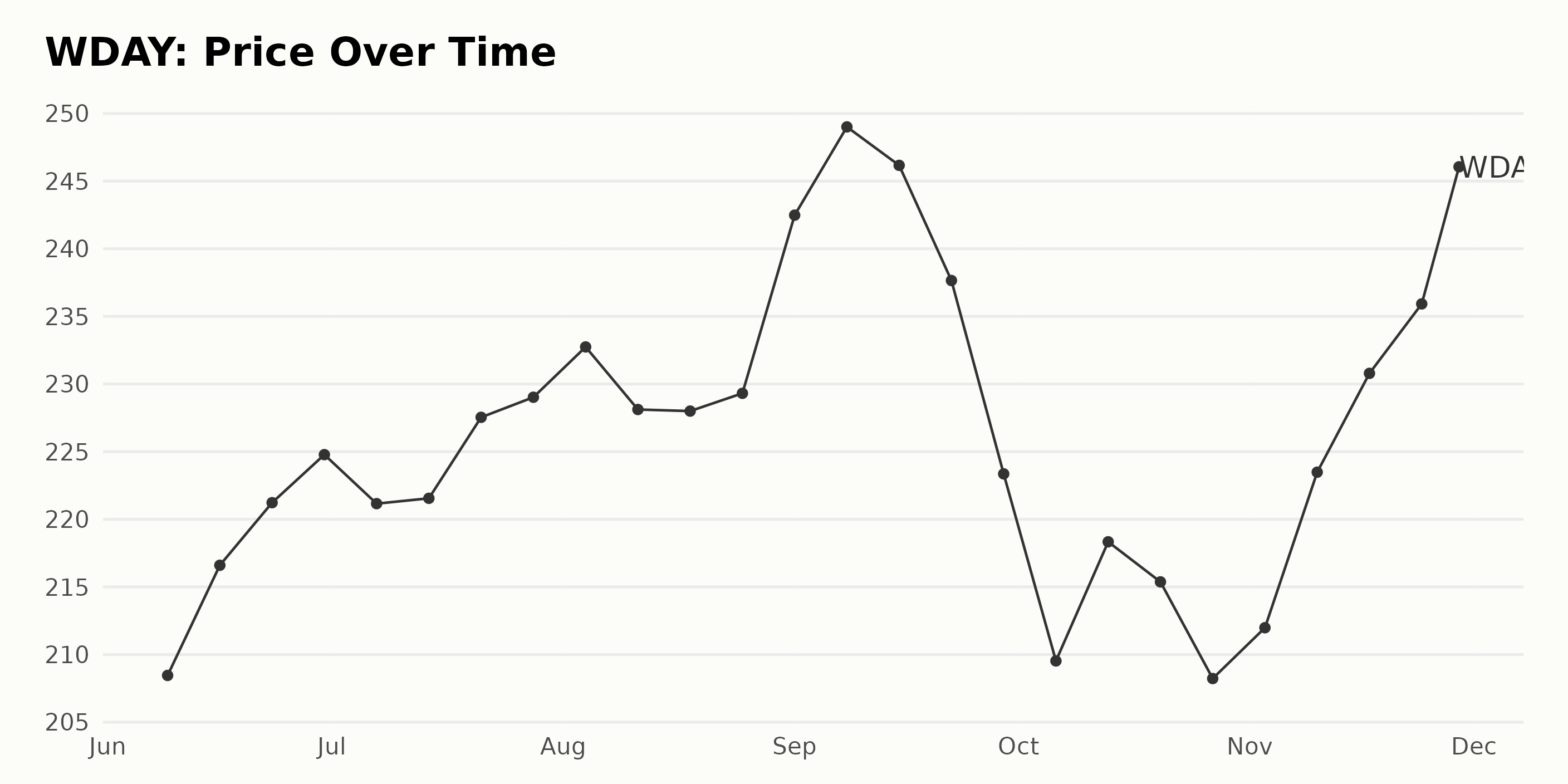

Analyzing Workday Inc.'s Growth and Volatility from June to November 2023

The share price data of WDAY shows a generally increasing trend from June to November 2023 with periods of fluctuation. Below is an analysis of the trend:

- On June 9, 2023, the share price was $208.46.

- By June 30, 2023, the share price increased to $224.78.

- In July, the price showed minor fluctuations but an overall increase, with the price reaching $229.02 on July 28, 2023.

- August maintained a slightly unstable trend, with the price peaking at $232.74 on August 4, 2023, and hitting a low at $227.998 on August 18, 2023.

- The most significant growth occurred in September, with the highest price recorded for the period at $249.01 on September 8, 2023. However, the price began to decline towards the end of September, dropping to $223.36 by September 29, 2023.

- October saw a continued decline, starting at $209.53 on October 6, 2023, until it decreased to $208.23 at the end of the month.

- Nevertheless, an ascent was noted in November, with the share price rising to $263.49 by November 29, 2023.

The trend demonstrated above indicates some volatility within this period, particularly in September, followed by October. Toward the end of 2023, prices saw a recovery period when they started increasing from the start of November.

In conclusion, the trend for WDAY share prices from June to November 2023 is upward, with periods of fluctuations. It also shows signs of accelerating growth towards the end of November after a period of decline in late September and October. Here is a chart of WDAY's price over the past 180 days.

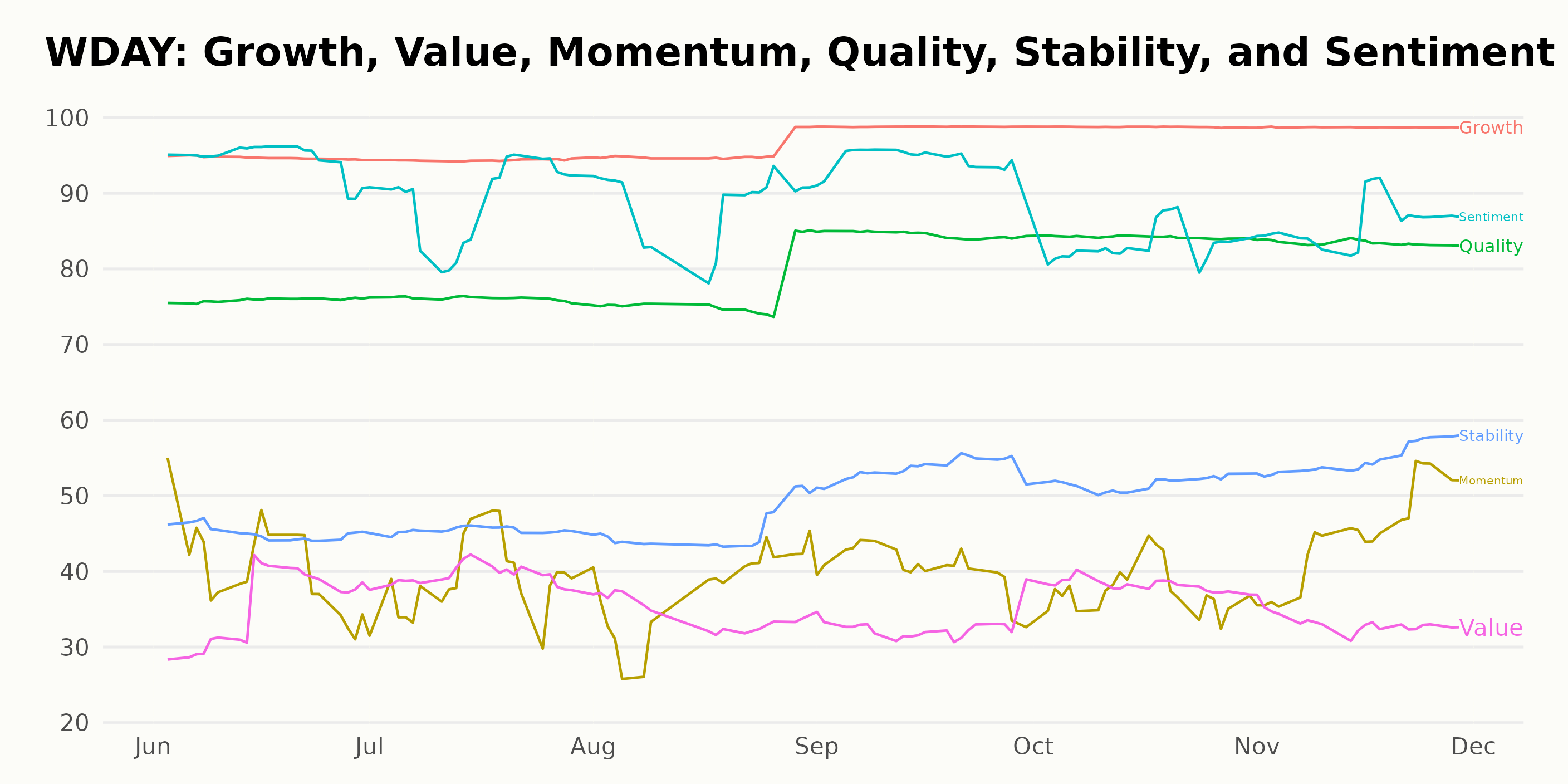

Analyzing Workday, Inc.'s Growth, Quality, and Sentiment Ratings in 2023

WDAY, which belongs to the Software - Application category of stocks comprising 132 stocks, carries the latest POWR Ratings grade of B (Buy). A detailed insight into its rank in the category for each week reveals:

- As of June 3, 2023-June 10, 2023, the company's rank was #33.

- By mid-June (June 17, 2023), it improved to #28 and further advanced to #27 by June 24, 2023.

- For early July to mid-July 2023, it oscillated between #28 and #32.

- In late July and early August 2023, it maintained a consistent ranking of #28.

- From August 9, 2023, to August 26, 2023, the rank deteriorated slightly between #32 and #35 before settling back at #33.

- The month of September 2023 witnessed a significant improvement in rank with WDAY moving as high as #19 and eventually settling at #20 by the end of the month.

- Throughout October 2023, WDAY maintained a competitive stance, with ranks generally fluctuating between #19 and #24.

- As of November 2023, the rank remained stable with little fluctuation, generally staying around the mid-20s figure.

The overall data, therefore, signals a competitive standing for WDAY within its category throughout this period.

The three most noteworthy dimensions of the POWR Ratings for WDAY are Growth, Quality, and Sentiment. These dimensions consistently show the highest ratings, with noticeable trends over certain time periods in 2023.

Growth - In June 2023, WDAY was recognized for growth with a rating of 95. It saw a slight dip to 94 in July but rebounded back to 95 by August. The Growth dimension showed a remarkable improvement in September, attaining a near-perfect score of 99. This impressive score continued until November.

Quality - The Quality dimension started at 76 in June 2023. It maintained consistent scores until August 2023, when it slightly improved to 77. By September, there was a significant upward trend, with the rating climbing to 85. This high rating stayed relatively stable, moving to 84 in October before reducing slightly to 83 in November.

Sentiment - Sentiment began with a high score of 95 in June 2023. There was a mild decrease in July to 89, which persisted until August. September witnessed a surge in sentiment to 94. The sentiment rating then displayed a downward trend, falling to 83 in October and slightly recovering to 86 in November.

This highlights a positive outlook for WDAY based on the Growth, Quality, and Sentiment dimensions within this period. The increasing trend in the Growth dimension suggests that the company's business expansion activities are well received.

Concurrently, constant high ratings in the Quality dimension indicate consistent performance and strong operational processes. The changes in Sentiment rating, while exhibiting some fluctuations, generally show positive investor sentiments towards WDAY during this timeframe.

How does Workday, Inc. (WDAY) Stack Up Against its Peers?

Other stocks in the Software - Application sector that may be worth considering are eGain Corporation (EGAN), TeamViewer SE (TMVWY), and Commvault Systems, Inc. (CVLT) - they have better POWR Ratings. Click here to explore more Software - Application stocks.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

WDAY shares were trading at $266.62 per share on Thursday afternoon, up $3.13 (+1.19%). Year-to-date, WDAY has gained 59.34%, versus a 20.03% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Analyzing Workday (WDAY) Q3 Earnings: Is December the Right Time to Invest? appeared first on StockNews.com