(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Last year I felt like the Paul Revere of investing letting everyone know that higher rates were coming.

At first, I looked quite foolish as rates stayed near historic lows even as the Fed clearly signaled their higher rate intentions. But saying and doing are 2 different things when the Fed dominates the bond market with their obscenely large $9 trillion balance sheet.

So as the Fed actually got to the doing part…and there were more bonds freely floating on the open market, that indeed got rates rising in a hurry and now approaching an interesting juncture at 3% for 10 year Treasuries.

Let’s talk about the journey that got us here…what happens next…and what that likely means for the stock market.

Market Commentary

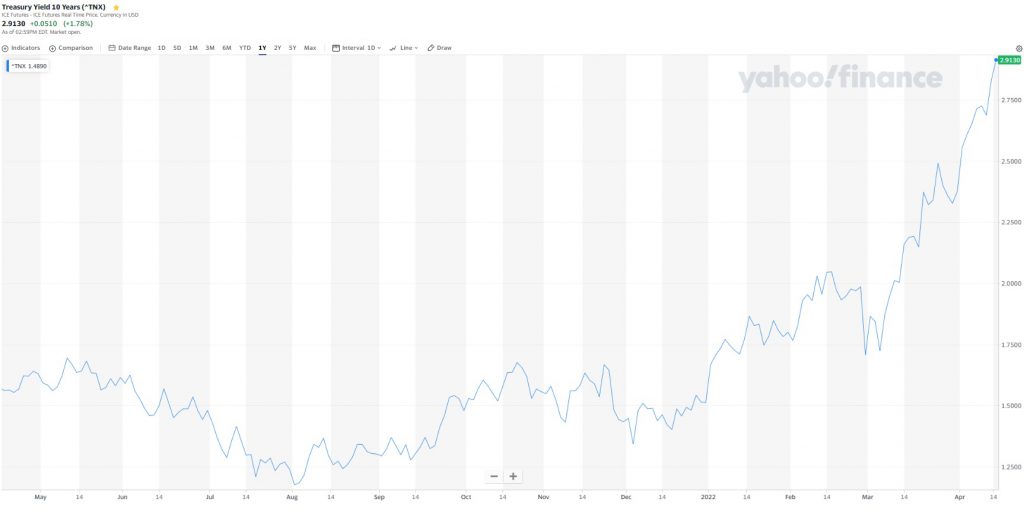

Let’s start with a chart of the 10 year Treasury rates over the past twelve months.

Truly this is the tale of 2 very different time periods. The first half with the Fed talking up their desire to raise rates with no real movement taking place.

The second half is a more than doubling of the rate from 1.34% in early December 2021 to just shy of 3% today.

This is great news for Reitmeister Total Return members as we have seen our largest position, (ticker reserved for Reitmeister Total Return subscribers…learn how to see the portfolio today), rally +54.81% in that short time frame.

However, this was bad news for many other investors as they have relied upon low rates as a seeming permanent floor supporting higher and higher stock prices. And yes, I also beat that drum pretty loudly under the banner of this being a “TINA” stock market.

There

Is

No

Alternative…to owning stocks

The theory being that when rates are this low that “cash is trash” as you will not make enough interest on your savings to cover the rate of inflation (that is shockingly true now).

Secondly, the rising rate environment is also a death knell for bond investments as rising rates = bond value losses. That is a wake up call to folks who incorrectly thought that bonds were a safe haven after a near 40 year bull market in bonds.

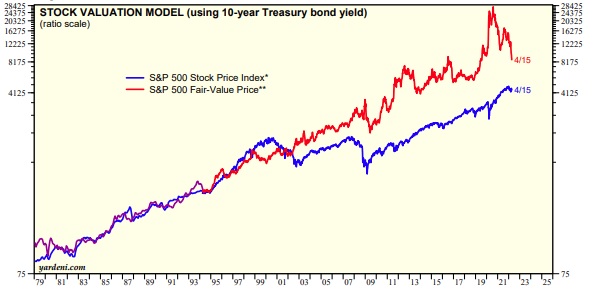

Add these together and it says that stocks are the best value in town. And honestly that is still true today as can be seen by this following chart:

This is an interesting comparison of the Earnings Yield of stocks versus the yield on 10 year Treasuries. What the left side of this chart shows is the historical norm. That being a world where the value of these 2 popular investments were basically in parity.

However, as the Great Recession came around Fed Chair Bernanke unveiled his low rate playbook which got the economy and stock market back on track. That’s because in a low rate environment EVERYTHING looks better than cash and bonds leading to more risk taking (like investing in businesses) which spikes the economy and stock market.

That playbook took on new meaning during the Covid crisis when the stock market bounced in late March even while the economy was being flushed down the toilet. Here again, because EVERYTHING looked better than cash or bonds when rates reached these new historic lows.

Back to the point…even with rates on the rise back to almost 3% in the present day, this chart proves that stocks are still the best investment in town. Because it says that parity value with the bond market would equate to a near doubling of the stock market from current levels.

This is the key reason why you need to keep a bullish bias in place even as inflation rages on…and the Fed is getting more hawkish…and Russia keeps up their attacks on the Ukraine. Because as we look at our investment options, we find that we are still very much in a TINA environment that points to higher share prices on the way.

What To Do Next?

Discover the current portfolio of hand 9 hand picked stocks and 5 ETFs inside the Reitmeister Total Return portfolio that are perfect for this hectic market environment.

Note this newsletter service firmly beat the market last year. And actually is in positive territory in 2022 as most other investors are enduring heavy losses.

How is that possible?

The clue is right there in the name: Reitmeister Total Return

Meaning this service was built to find positive returns in all market environments. Not just when the bull is running full steam ahead. Heck, anyone can profit in that environment.

Yet when stocks are trending sideways, or even worse, heading lower…then you need to employ a different set of strategies to be successful.

Come discover what 40 years of investing experience can do you for you.

Plus get immediate access to my full portfolio of 9 stocks and 5 ETFs that are primed to excel in this unique market environment. (This includes 2 little known investments that actually profit from rising rates).

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares . Year-to-date, SPY has declined -6.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Raging Rates & Stock Market Outlook appeared first on StockNews.com