( click to enlarge )

( click to enlarge )Shares of Second Sight Medical Products Inc (NASDAQ:EYES) surged 9.31% to $5.99 per share on massive volume after the news that the UCHealth Eye Center at University of Colorado Hospital has performed the first "bionic eye" procedure, restoring limited sight to a woman who has been blind for almost two decades. From a technical standpoint, the chart shows a bullish sign as the stock is back on top of its short-term EMAs. In addition, MACD is rising and RSI is back above 50% level which show beginning of bull market rally. I classify the declining 50EMA as a key resistance line since it has caused significant turning points in the price and held on the last three tests. However, a sustained break should bring the stock to a test of the recent highs around the $8 level. There seems to be a lot of room to run higher here. EYES is a short squeeze candidate.

( click to enlarge )

( click to enlarge )Vringo, Inc. (NASDAQ:VRNG) stock printed a doji candlestick in Thursday's trading, which indicates a potential reversal. I believe there is a high probability of seeing a meaningful bounce in the stock in coming days. Note: RSI marks oversold.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) A big day for Blackberry. The stock surged on Thursday more than 7% to 7.89 per share on a strong volume expansion as a result of Wal-Mart's website indicating that company's Priv smartphone is currently sold out. From a technical perspective, the stock is starting to make a move to break through the recent top of its range. This is a good stock to watch and once it breaks through the 200-day EMA on a close basis the should move higher. With a short interest of 15 percent of float and more than 16 days to cover all shares when it takes off it will be very fast.

( click to enlarge )

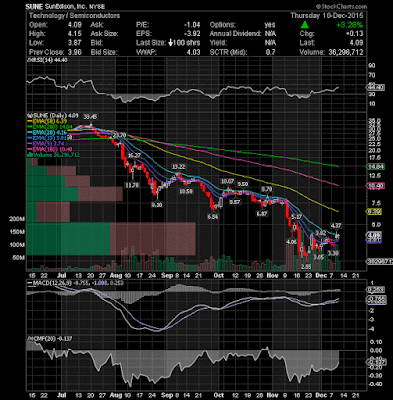

( click to enlarge )Sunedison Inc (NYSE:SUNE) looks poised for a break to the upside. Waiting for a break and close above the 4.37 level for a long position. Price will continue to move up as long as it sustains above the rising 9-day EMA.

( click to enlarge )

( click to enlarge )Apollo Education Group Inc (NASDAQ:APOL) is a bottom play trying to make a shift in trend. From a technical standpoint, the stock shows a bullish divergence on MACD. To return to rally mode the stock price needs to cross its short-term resistance at 8. A move above this level would be positive for the stock.

( click to enlarge )

( click to enlarge )Plug Power Inc (NASDAQ:PLUG) Price reclaimed its 20-day EMA and broke out of the small descending channel, which is bullish. This looks to be just the beginning of PLUG's run and I am confident that the gains will continue. The MACD momentum is rising and the relative strength index is turning up. Next key resistance is now located around $2.23

( click to enlarge )

( click to enlarge )I have been following Tetraphase Pharmaceuticals Inc (NASDAQ:TTPH) for a few days now and surprisingly the stock showed some strength today. Volume starts to pick up. Nearest resistance for the stock is now located at 10.72 (20EMA). If this level is crossed and the stock price is able to sustain above this level, then it might go to 12

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC