OVERLAND PARK, KS / ACCESS Newswire / January 22, 2025 / Managing personal finances today seems to be more crucial - or more challenging than in years past. With a competitive job market, issues around persistent inflation, personal debt on the rise, and more, it can feel near impossible to get ahead financially. The American Dream is still alive, but current economic conditions and social expectations are making it more challenging to come to fruition.

Today, Kedrec, an independent financial planning practice, is proud to announce the release of Cash Flow and Capital, a new app designed to help people develop a healthier relationship with their money. "We believe most people have the resources they need to build the life they want," says Michael Decker, founder and CEO of Kedrec and Cash Flow and Capital. "It may require some painful lessons and difficult lifestyle adjustments, but the American Dream is still alive. We believe that with the right tools and systems, and a dedicated mindset, most Americans can alter their stars and create a better life for themselves."

Develop a Healthier Relationship With Your Money

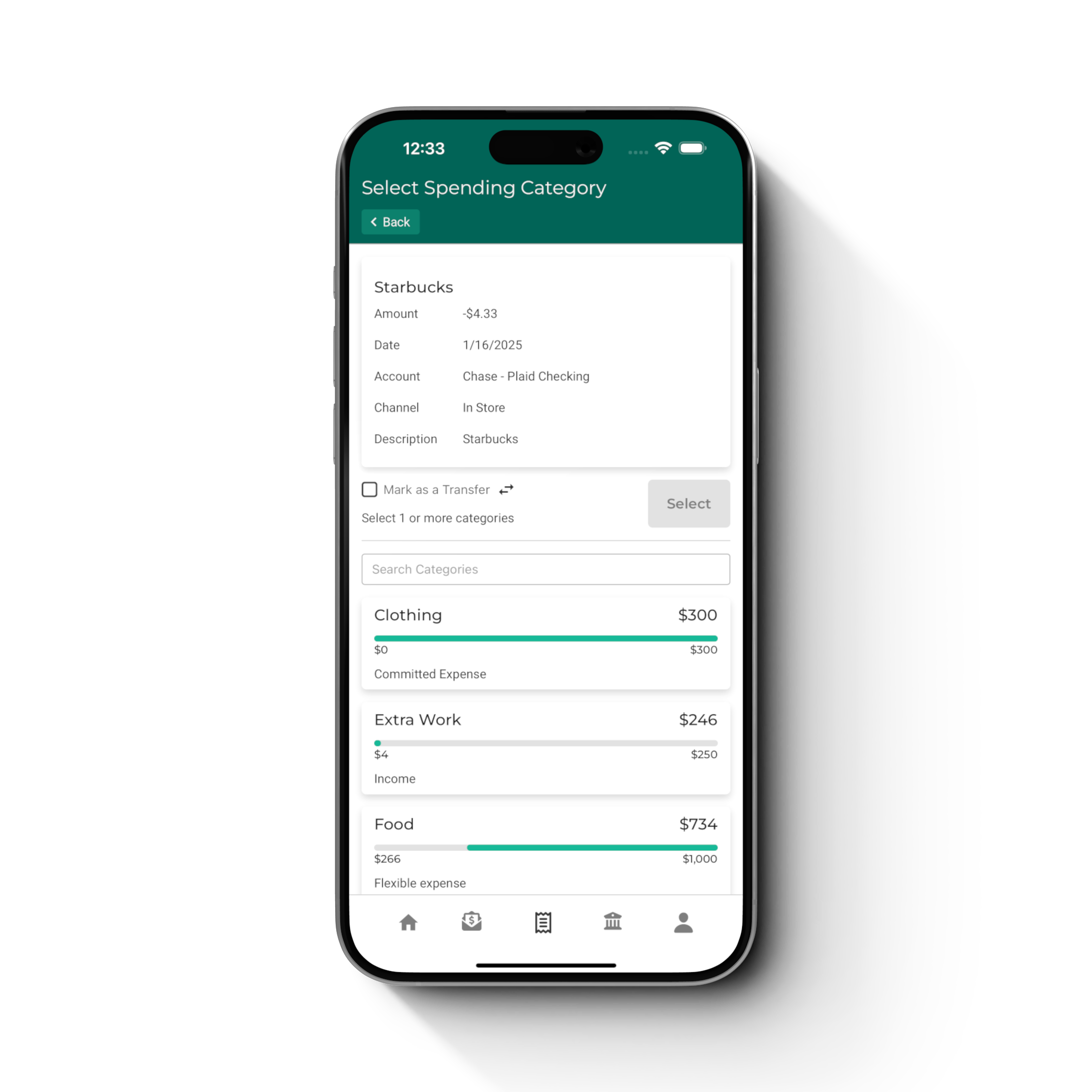

Cash Flow and Capital is a personal finance app that takes an unconventional budgeting / spending plan approach by requiring the user to manually sort every transaction. "You can't solve problems you don't know exist," says Decker. "Too much automation has created many blind spots. We don't feel the pain of spending our money when we use credit cards. That's why we created an app that would allow users to feel the pain of their spending when they categorize their transactions. Unless the pain of change becomes less than the pain of the current path or behavior, people won't change. We want to help people heal. That means we need to help people want to change their behavior so they can make healthier decisions with their money."

Cash Flow and Capital utilizes Plaid, an integration that securely connects the users' financial accounts so that all transactions are automatically and securely uploaded to the app. Once uploaded, users are then intentionally required to categorize their transactions manually. This simple yet seemingly inconvenient feature is expected to help users raise their awareness and ultimately make healthier financial decisions. "We want the user to feel the pain of each transaction. We want them to feel the loss of spending their money. There's no better medicine when it comes to managing personal finances than the feeling of loss," says Decker.

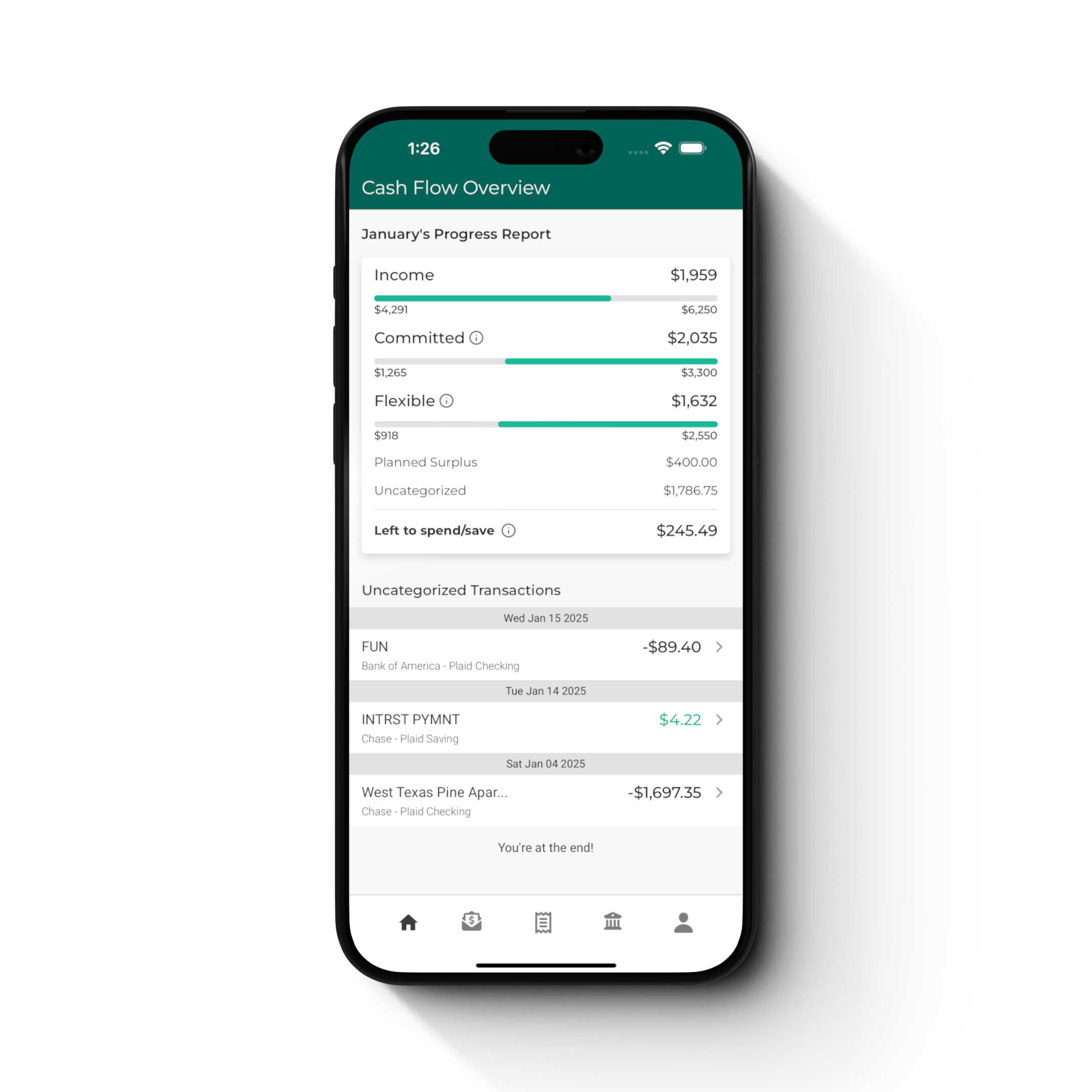

A More Realistic Cash Flow Overview

"One of the main pitfalls when it comes to monitoring someone's personal cash flow is the assumption that people have a say over every dollar they bring in as income," explains Decker. "When you take on debt or sign up for services, like utilities, you have very little wiggle room, if any. In other words, you've committed a part of your monthly cash flow to that bill or payment, regardless of other life events. Many people do not realize until it's too late that the majority of their monthly income goes to fixed or committed expenses. That can feel suffocating."

Cash Flow and Capital takes a unique approach by simplifying the users' spending plan and monthly progress down to one number. Instead of overwhelming the users with data, they take the users' total income minus the committed expenses, like a mortgage, rent, utilities, and so on, and then subtract how much has been spent in flexible transactions that month. In other words, the user can see how much money they have to work with for the rest of the month within their lifestyle or flexible spending plan. Here's the equation:

Total income - total committed expenses planned - total flexible expenses spent month-to-date = how much you have left to spend this month.

"It's very sobering to see how much control you actually have over your monthly cash flow," says Decker. "Users can see as much or as little data as they want, which is the point. Meet people where they are and help them live within certain principles so they can prosper."

Make Your Spending Plan Make Sense to You

"We recognize that there are many ways someone could put together their budget or spending plan," explains Decker. "Some people want to account for every penny that comes in and goes out. Others like to keep it simple with a balance between needs and wants. Most will probably fall somewhere in the middle. That's why we wanted to make sure the categories were 100% customizable. The app needs to work for all types of people."

Many popular budget or spending plans work well within the Cash Flow and Capital app, including:

The 50/30/20 Rule (Needs/Wants/Savings)

Zero-Based Budgeting

Envelope System

Pay Yourself First

Line-Item Budgeting

The Anti-Budget (Minimal effort for those who dislike detailed budgeting)

Value-Based Budgeting

Goals-Based Budgeting

Debt Elimination Budgeting

Reverse Budgeting

And more

"There's more than one way to approach budgeting. We believe in putting principles first and preferences second. The principle here is to spend less than you earn and to track what you do. Everything is else preferential and should make sense to the user," says Decker.

Empowering Financial Independence

"This is just the start to what will be a series of tools and resources intended to help people understand the nuance of how money works and ultimately help people make healthier financial decisions," says Decker.

"Our goal is to help people heal from trauma or correct cognitive distortions that may be holding them back financially and personally. We believe that unless your financials are in order, it can be very difficult to address any other pressing personal issues. That is why we built this app. We wanted to offer self-healing systems that can track habits while helping people identify principles being violated. Once an individual can identify a principle being violated, they can begin their healing journey as they put principles first, preferences second, and ultimately correct a behavior that is preventing them from being the best version of themselves. If we can help them do that, then perhaps we can make a positive difference in the world."

Contact Name: Mike Decker

Business Name: Kedrec, LLC

Phone Number: 855-553-3732

Kedrec, LLC offers comprehensive wealth planning and management services. Investment advisory services are offered through Kedrec, LLC, a Kansas state Registered Investment Advisor. Insurance products and services are offered through its affiliate, Kedrec Legacy, LLC. Investing involves risk, including possible loss of principal. No investment strategy can guarantee financial success. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

SOURCE: Kedrec, LLC

View the original press release on ACCESS Newswire