As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at safety & security services stocks, starting with GEO Group (NYSE: GEO).

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

The 5 safety & security services stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

While some safety & security services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.9% since the latest earnings results.

Weakest Q1: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

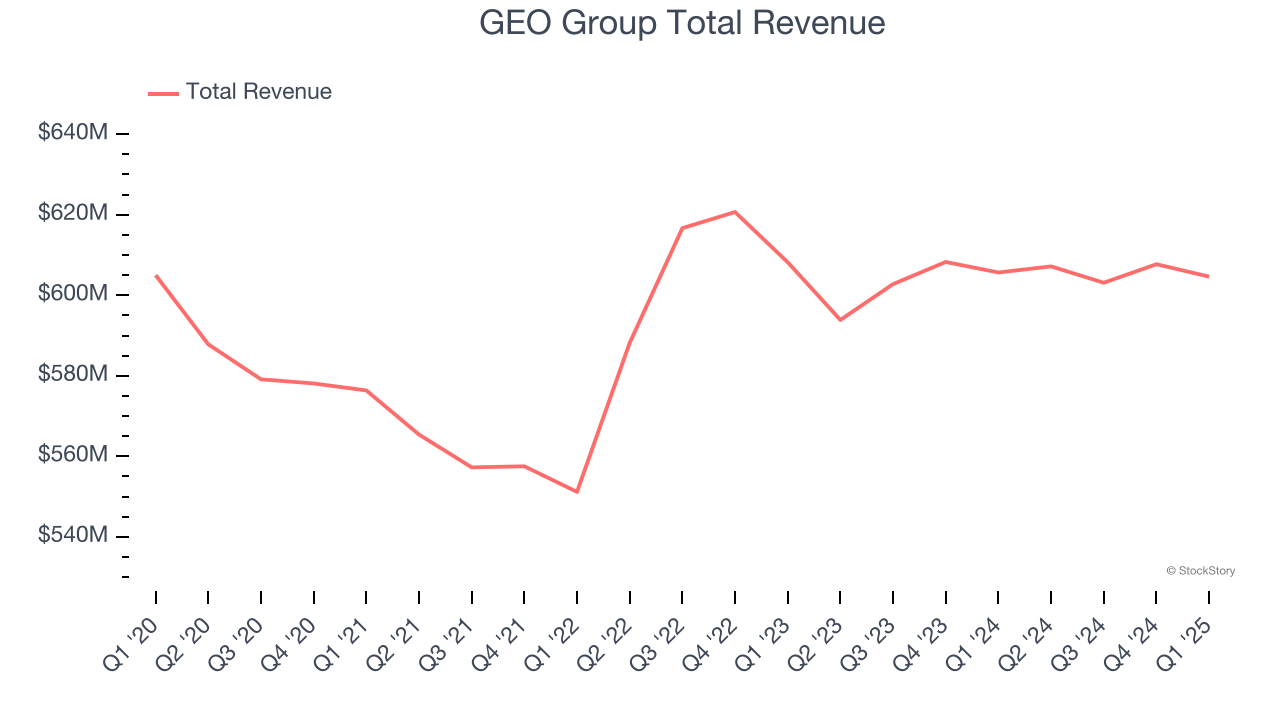

GEO Group reported revenues of $604.6 million, flat year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

George C. Zoley, Executive Chairman of GEO, said, “We are pleased with the progress we have made towards meeting our growth and capital allocation objectives. During the first quarter of 2025, we announced two important contract awards for the reactivation of two company-owned facilities totaling 2,800 beds and representing in excess of $130 million in annualized revenues. We believe we have an unprecedented opportunity to assist the federal government in meeting its expanded immigration enforcement priorities. We have taken several important steps to be prepared to meet that opportunity, including making a significant investment commitment of $70 million to strengthen our capabilities to deliver expanded detention capacity, secure transportation, and electronic monitoring services to ICE and the federal government. We also recently completed a reorganization of our senior management team to oversee the operational execution of this expected future growth activity.”

GEO Group delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 13.8% since reporting and currently trades at $26.13.

Read our full report on GEO Group here, it’s free.

Best Q1: CoreCivic (NYSE: CXW)

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

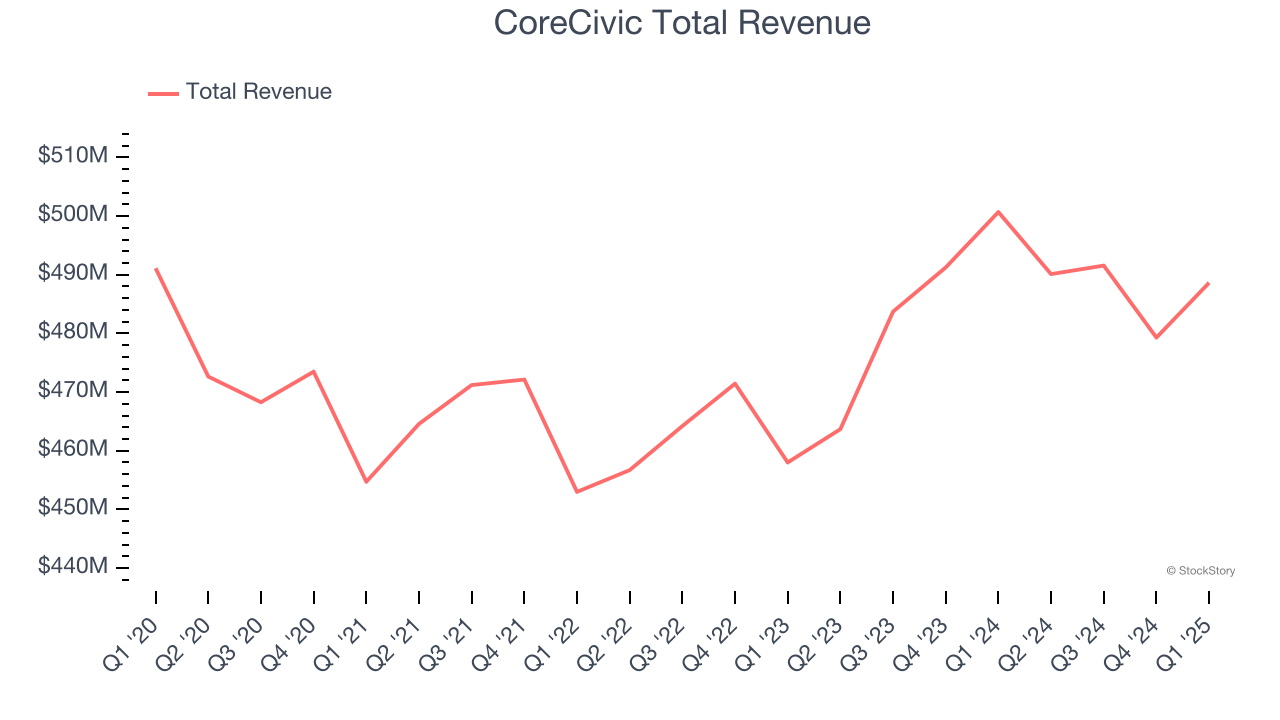

CoreCivic reported revenues of $488.6 million, down 2.4% year on year, outperforming analysts’ expectations by 2.5%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $22.38.

Is now the time to buy CoreCivic? Access our full analysis of the earnings results here, it’s free.

Brady (NYSE: BRC)

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE: BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady reported revenues of $382.6 million, up 11.4% year on year, falling short of analysts’ expectations by 1%. It was a slower quarter as it posted a slight miss of analysts’ full-year EPS guidance estimates.

As expected, the stock is down 8.8% since the results and currently trades at $69.50.

Read our full analysis of Brady’s results here.

Brink's (NYSE: BCO)

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's (NYSE: BCO) provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

Brink's reported revenues of $1.25 billion, flat year on year. This number beat analysts’ expectations by 2.8%. Taking a step back, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $94.66.

Read our full, actionable report on Brink's here, it’s free.

MSA Safety (NYSE: MSA)

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE: MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

MSA Safety reported revenues of $421.3 million, up 1.9% year on year. This print topped analysts’ expectations by 5%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EPS estimates.

MSA Safety pulled off the biggest analyst estimates beat among its peers. The stock is up 13.8% since reporting and currently trades at $175.

Read our full, actionable report on MSA Safety here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.