The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how automation software stocks fared in Q1, starting with ServiceNow (NYSE: NOW).

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 5.9% while next quarter’s revenue guidance was in line.

Luckily, automation software stocks have performed well with share prices up 14.2% on average since the latest earnings results.

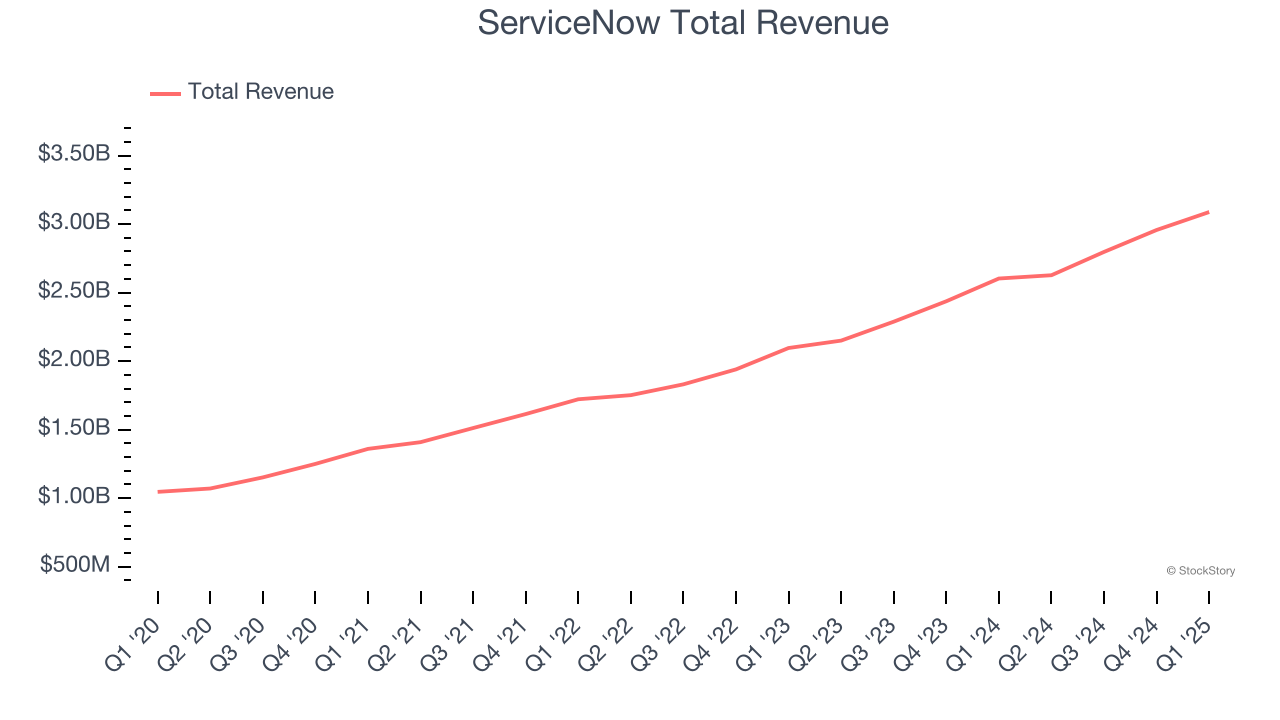

ServiceNow (NYSE: NOW)

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE: NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $3.09 billion, up 18.6% year on year. This was a strong quarter, with cRPO (current remaining performance obligations) and RPO (remaining performance obligations) both beating. Although reported revenue just met expectations, profitability outperformed, leading to beats for adjusted operating income and adjusted EPS.

“ServiceNow’s position as the platinum standard for enterprise-grade AI drove these outstanding first quarter results,” said ServiceNow Chairman and CEO Bill McDermott.

Interestingly, the stock is up 19.3% since reporting and currently trades at $971.52.

Is now the time to buy ServiceNow? Access our full analysis of the earnings results here, it’s free.

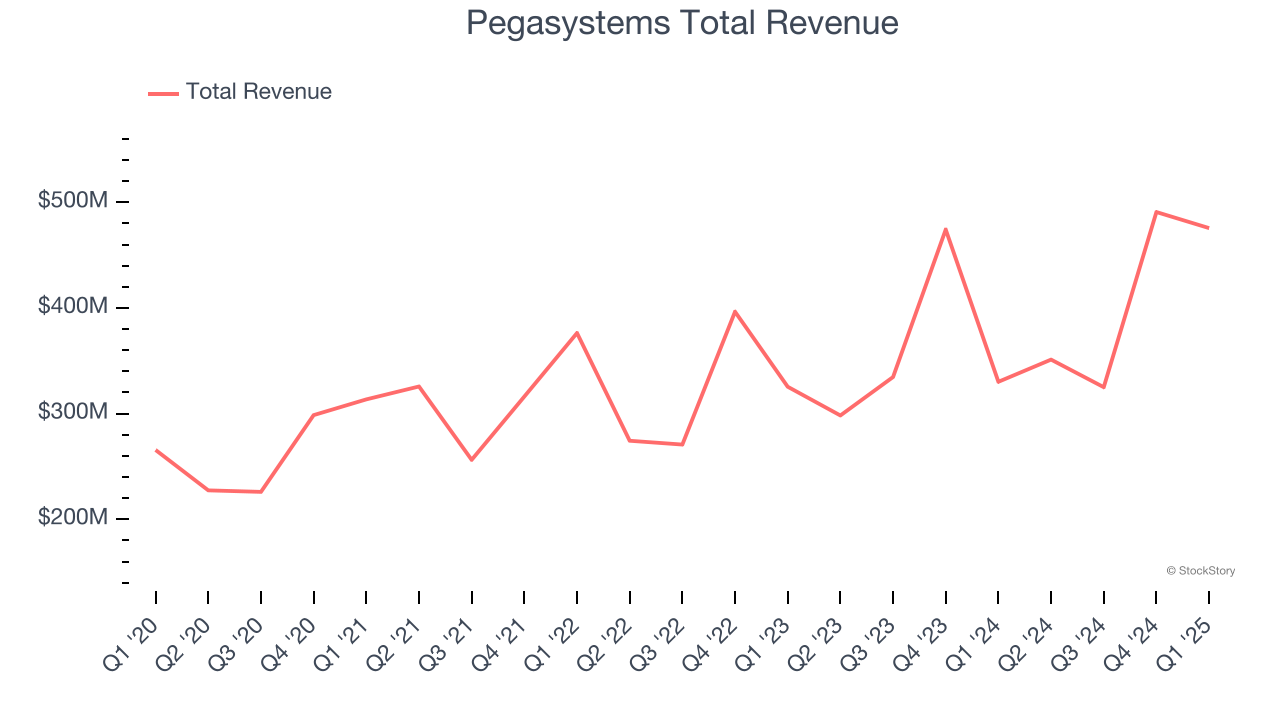

Best Q1: Pegasystems (NASDAQ: PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 49.7% since reporting. It currently trades at $51.50.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 26% since the results and currently trades at $12.26.

Read our full analysis of SoundHound AI’s results here.

Appian (NASDAQ: APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $166.4 million, up 11.1% year on year. This print topped analysts’ expectations by 2%. Zooming out, it was a mixed quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

Appian had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $30.26.

Read our full, actionable report on Appian here, it’s free.

Jamf (NASDAQ: JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ: JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $167.6 million, up 10.2% year on year. This result surpassed analysts’ expectations by 0.8%. More broadly, it was a mixed quarter as it also produced full-year revenue guidance topping analysts’ expectations but annual recurring revenue in line with analysts’ estimates.

Jamf pulled off the highest full-year guidance raise among its peers. The stock is down 23.4% since reporting and currently trades at $8.70.

Read our full, actionable report on Jamf here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.