Hancock Whitney currently trades at $57.44 per share and has shown little upside over the past six months, posting a middling return of 4.7%.

Is now the time to buy Hancock Whitney, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Hancock Whitney Not Exciting?

We're sitting this one out for now. Here are three reasons why you should be careful with HWC and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

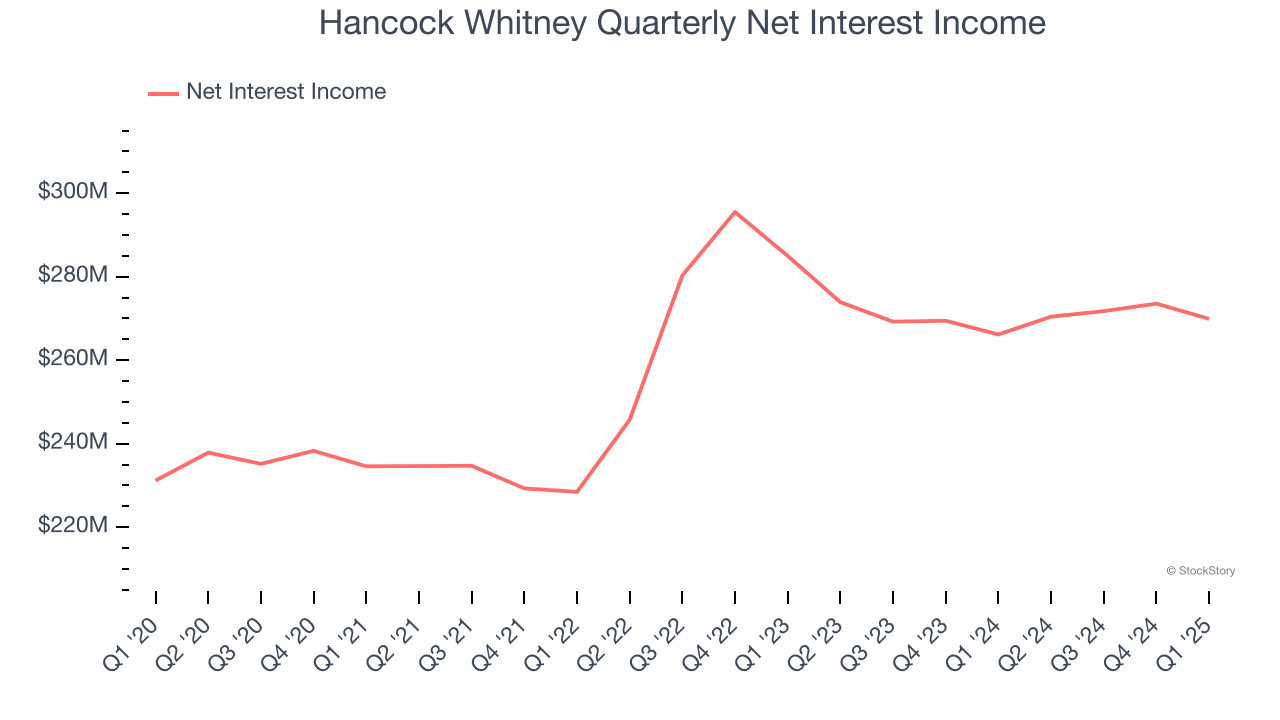

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Hancock Whitney’s net interest income has grown at a 3.5% annualized rate over the last four years, worse than the broader bank industry.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Hancock Whitney’s net interest income to rise by 5.3%.

3. Low Net Interest Margin Hinders Flexibility

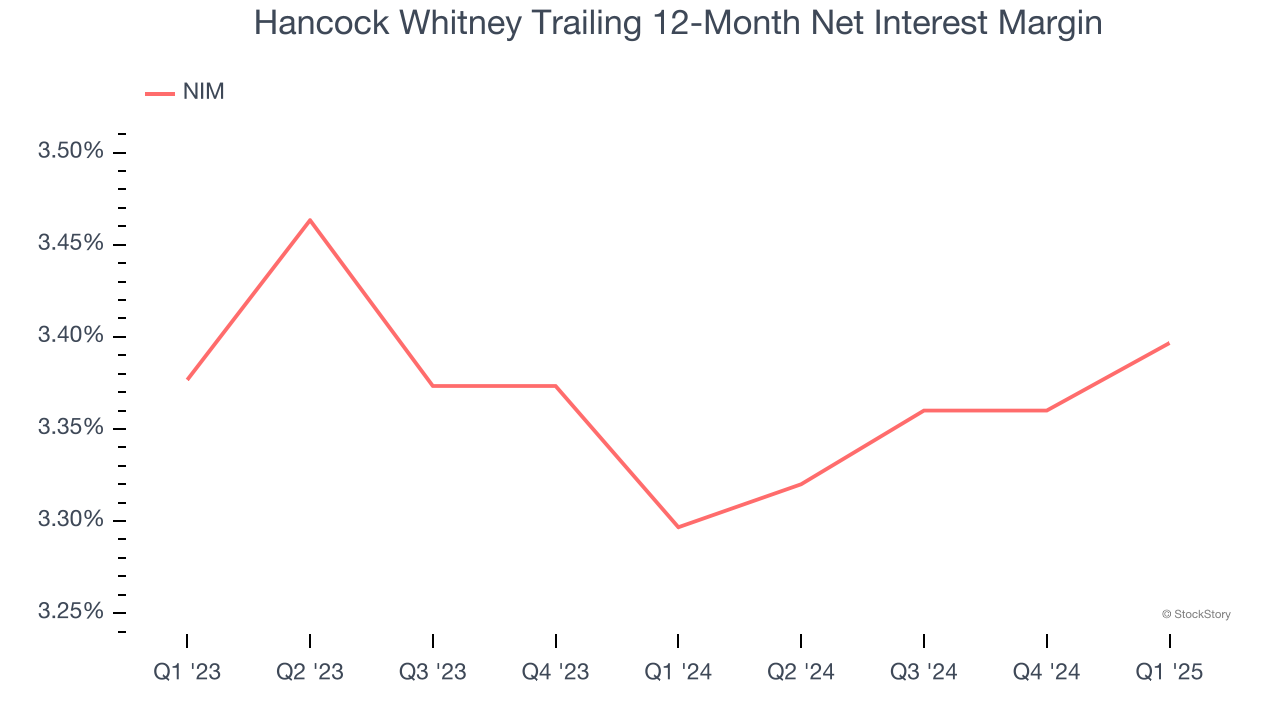

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, we can see that Hancock Whitney’s net interest margin averaged a subpar 3.3%, meaning it must compensate for lower profitability through increased loan originations.

Final Judgment

Hancock Whitney’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.1× forward P/B (or $57.44 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.