Over the last six months, First Busey’s shares have sunk to $22.21, producing a disappointing 8.5% loss - a stark contrast to the S&P 500’s 1.7% gain. This may have investors wondering how to approach the situation.

Is now the time to buy First Busey, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is First Busey Not Exciting?

Even though the stock has become cheaper, we're swiping left on First Busey for now. Here are three reasons why you should be careful with BUSE and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

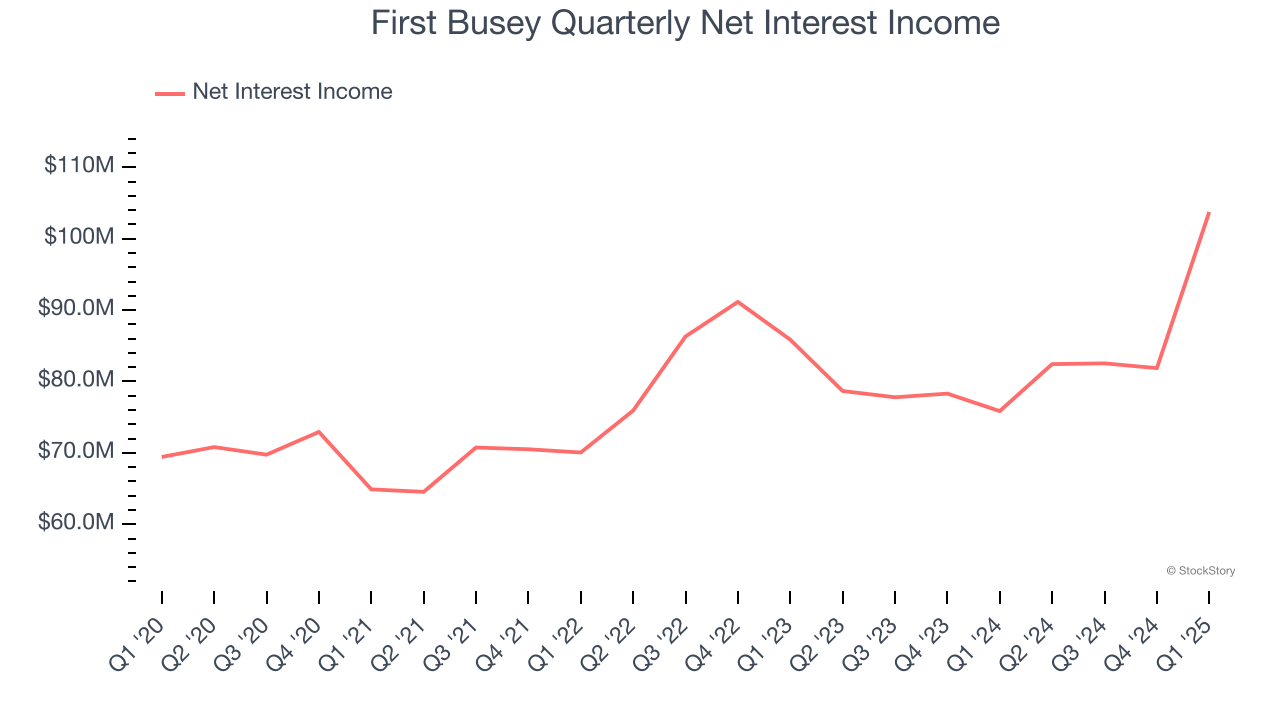

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

First Busey’s net interest income has grown at a 5.9% annualized rate over the last four years, worse than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

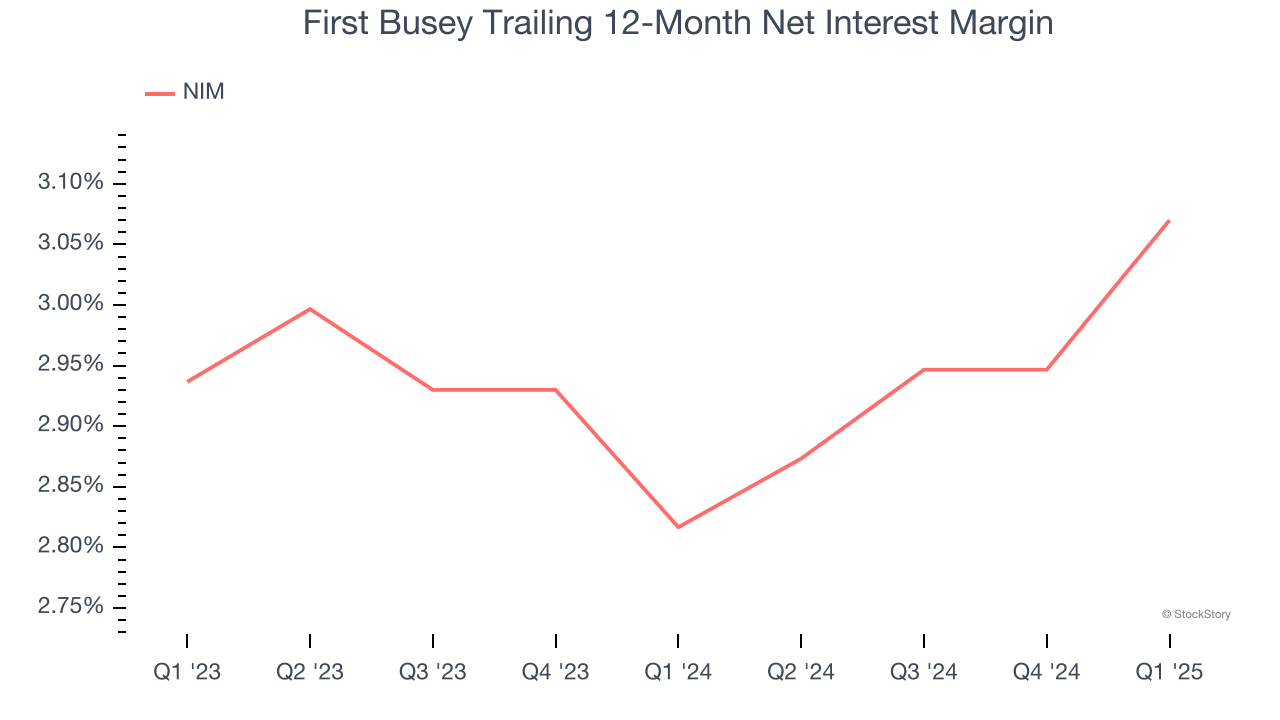

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that First Busey’s net interest margin averaged a weak 2.9%, meaning it must compensate for lower profitability through increased loan originations.

3. Deteriorating Efficiency Ratio

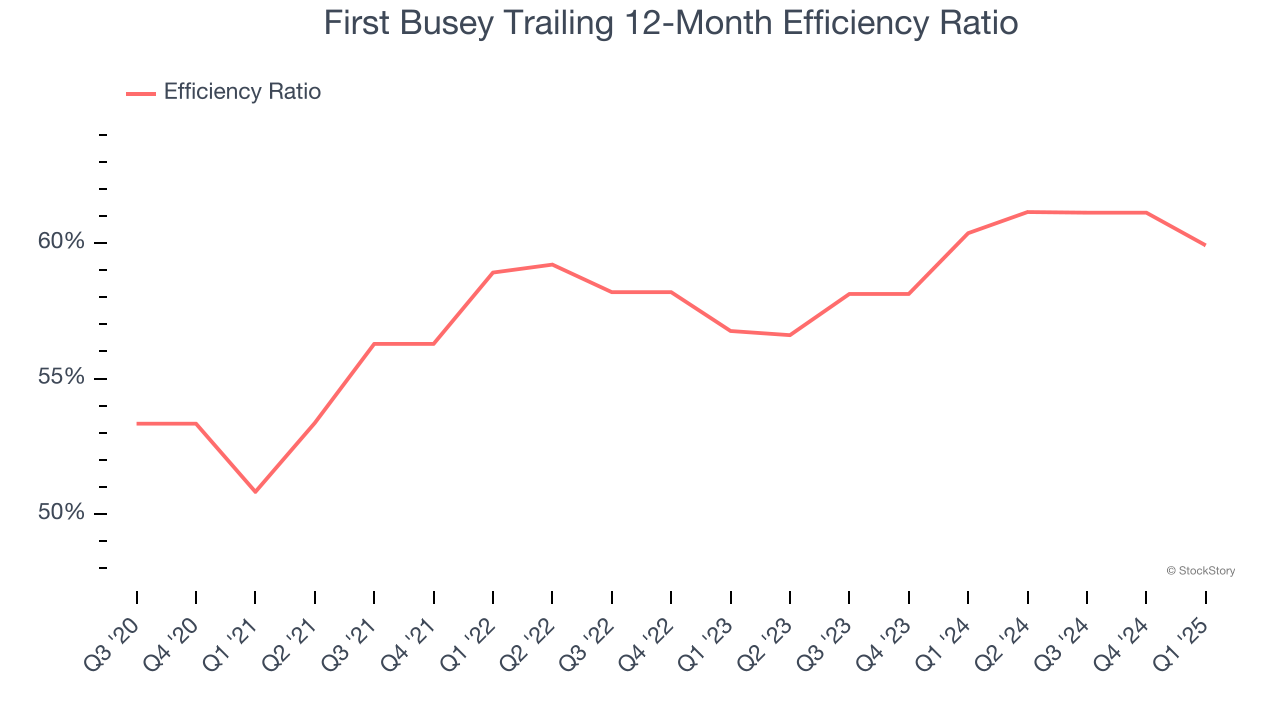

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Markets understand that a bank’s expense base depends on its revenue mix and what mostly drives share price performance is the change in this ratio, rather than its absolute value. It’s somewhat counterintuitive, but a lower efficiency ratio is better.

Over the last four years, First Busey’s efficiency ratio has swelled by 9.1 percentage points, hitting 59.9% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

Final Judgment

First Busey isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 0.9× forward P/B (or $22.21 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.