Shareholders of Benchmark would probably like to forget the past six months even happened. The stock dropped 20.7% and now trades at $35.66. This might have investors contemplating their next move.

Is now the time to buy Benchmark, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why there are better opportunities than BHE and a stock we'd rather own.

Why Do We Think Benchmark Will Underperform?

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE: BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

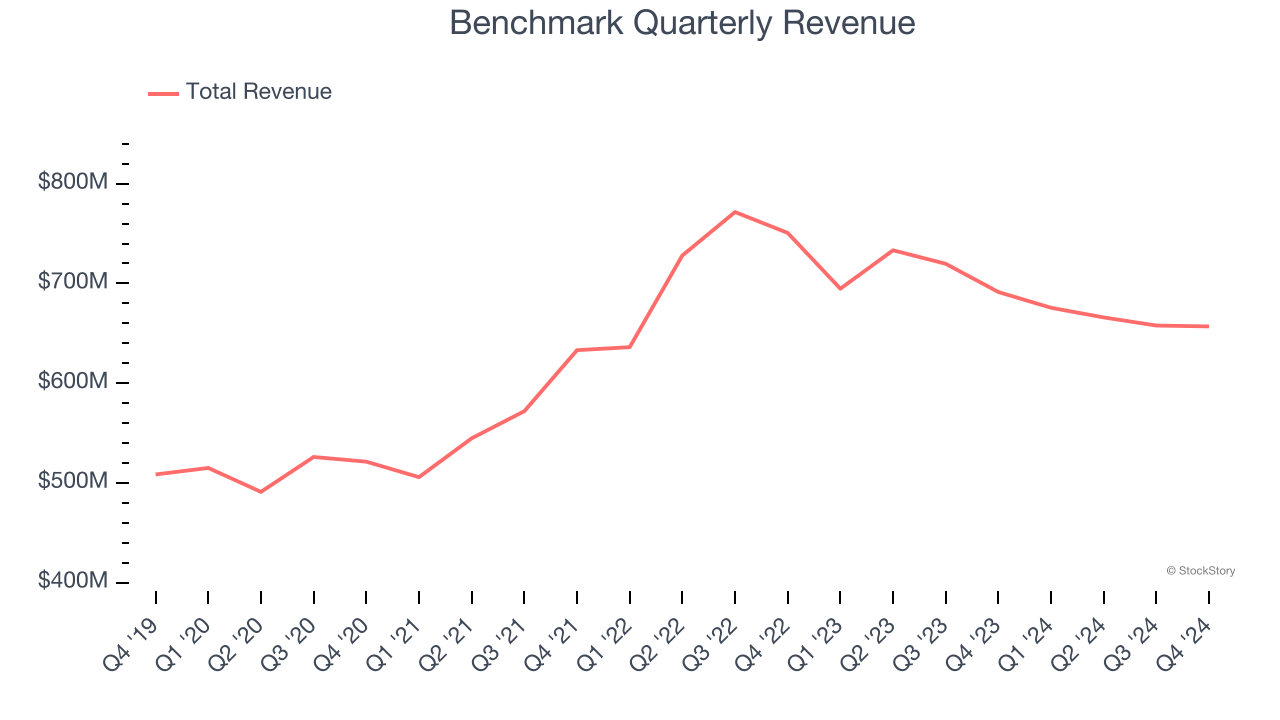

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Benchmark grew its sales at a tepid 3.2% compounded annual growth rate. This was below our standard for the business services sector.

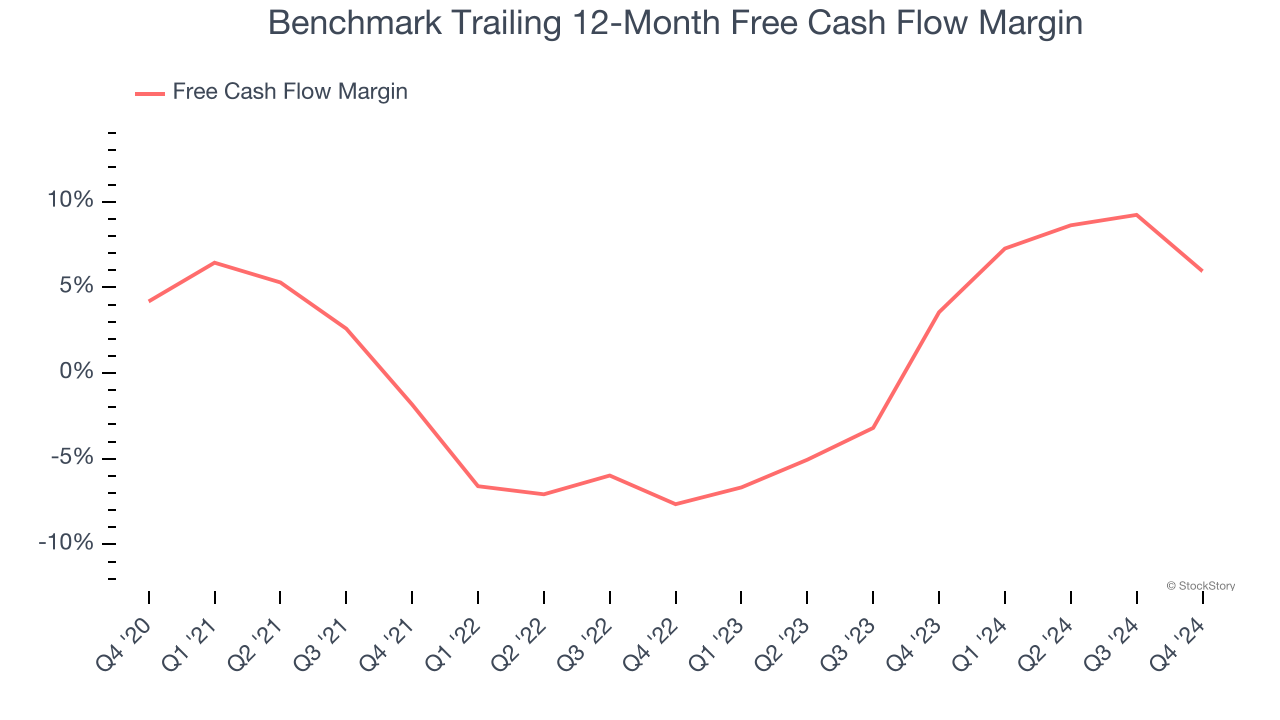

2. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Benchmark broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

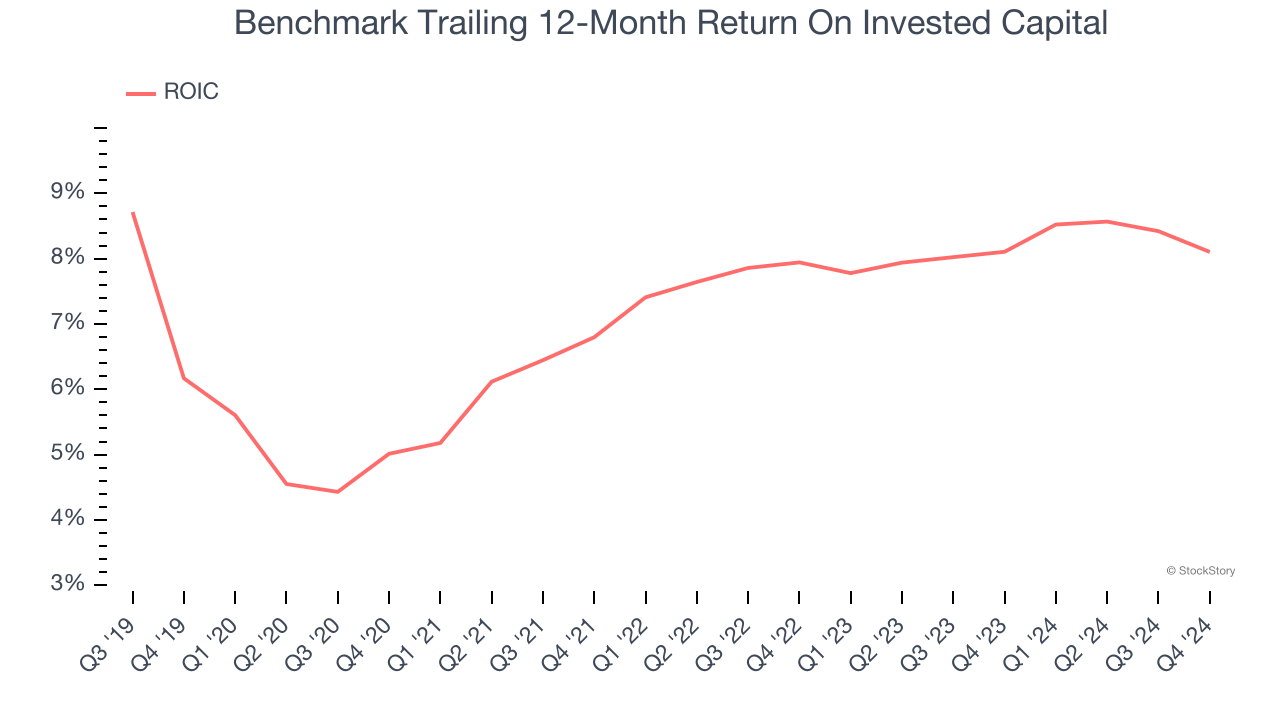

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Benchmark historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

Final Judgment

Benchmark doesn’t pass our quality test. After the recent drawdown, the stock trades at 14.5× forward price-to-earnings (or $35.66 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Benchmark

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.