Self-storage and building solutions company Janus (NYSE: JBI) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 12.5% year on year to $230.8 million. The company’s full-year revenue guidance of $875 million at the midpoint came in 3% above analysts’ estimates. Its non-GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Janus? Find out by accessing our full research report, it’s free.

Janus (JBI) Q4 CY2024 Highlights:

- Revenue: $230.8 million vs analyst estimates of $186 million (12.5% year-on-year decline, 24.1% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $34.6 million vs analyst estimates of $26.92 million (15% margin, 28.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $875 million at the midpoint, beating analyst estimates by 3% and implying -9.2% growth (vs -9.4% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $185 million at the midpoint, above analyst estimates of $173.6 million

- Free Cash Flow Margin: 19.6%, down from 23.9% in the same quarter last year

- Market Capitalization: $1.14 billion

“Even with the difficult market conditions we saw unfold during 2024, we remain confident in our long-term value proposition and believe the fundamentals that drive our industry remain intact,” Ramey Jackson, Chief Executive Officer, stated, “We’re proud of what we accomplished this year including the acquisition and integration of TMC and the launch of our Nokē Ion and NS door products.

Company Overview

Standing out with its digital keyless entry into self-storage room technology, Janus (NYSE: JBI) is a provider of easily accessible self-storage solutions.

Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

Sales Growth

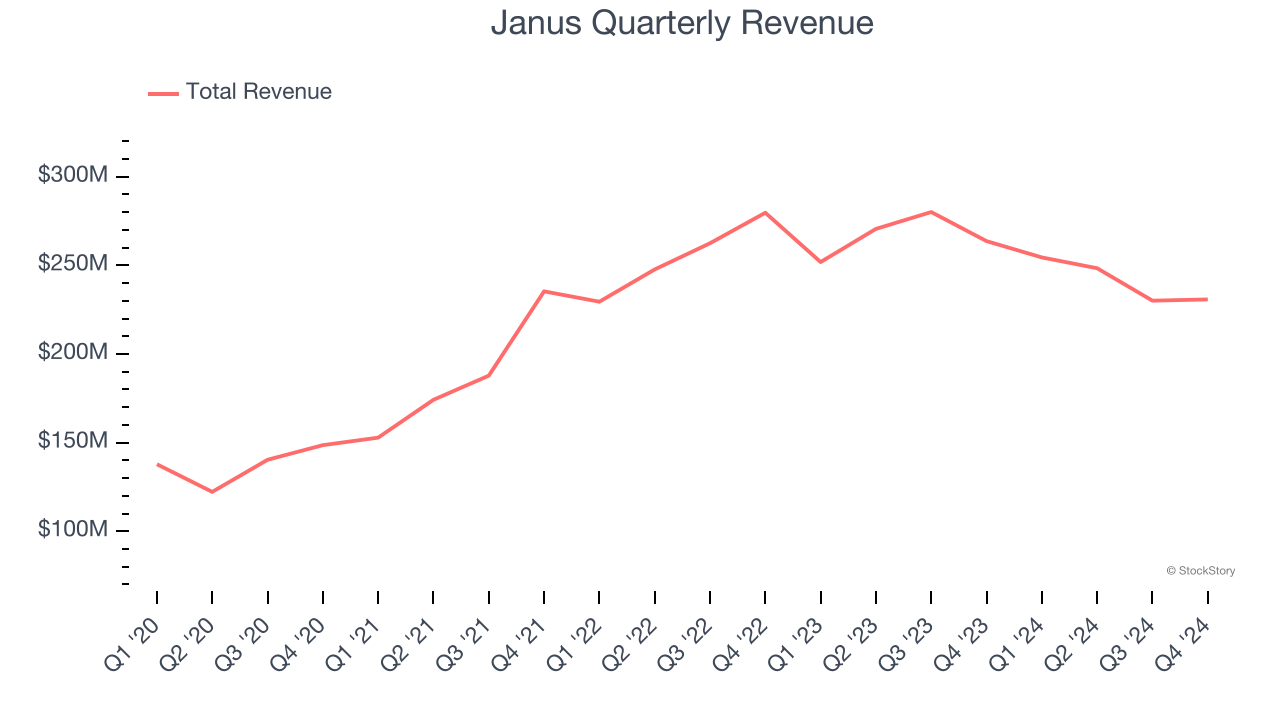

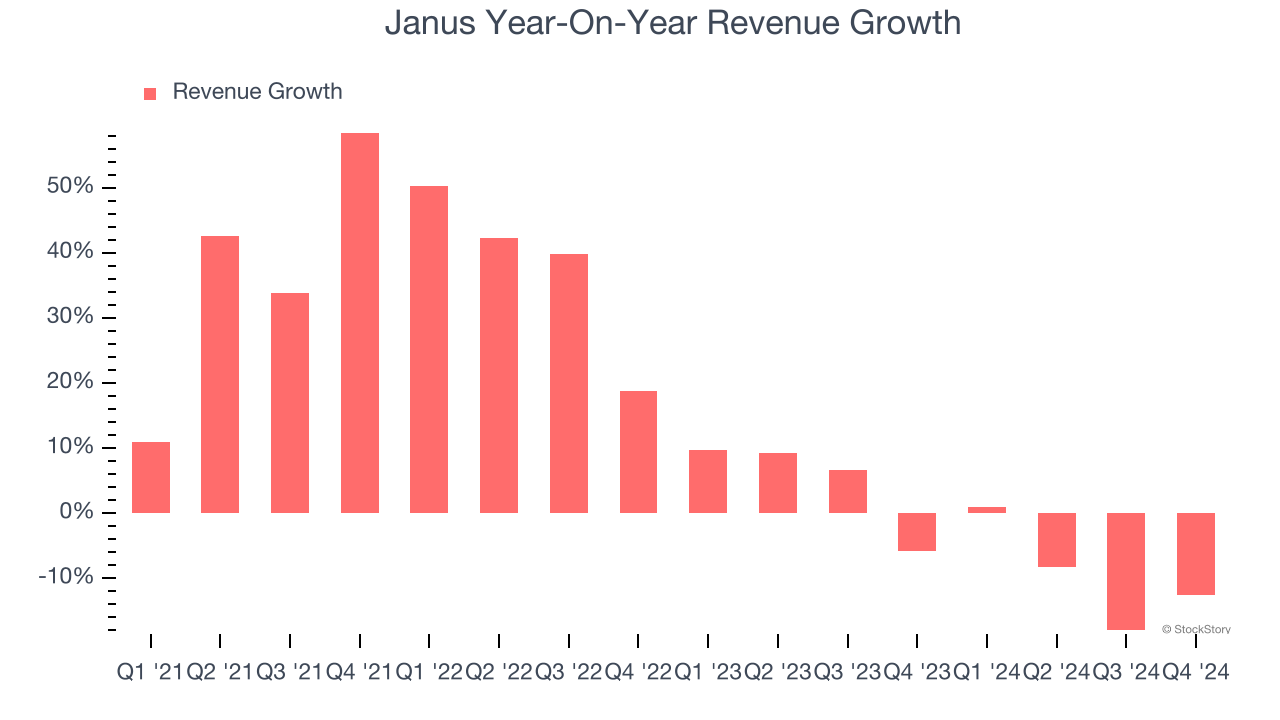

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last four years, Janus grew its sales at an incredible 15.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Janus’s recent history marks a sharp pivot from its four-year trend as its revenue has shown annualized declines of 2.8% over the last two years.

This quarter, Janus’s revenue fell by 12.5% year on year to $230.8 million but beat Wall Street’s estimates by 24.1%.

Looking ahead, sell-side analysts expect revenue to decline by 13.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

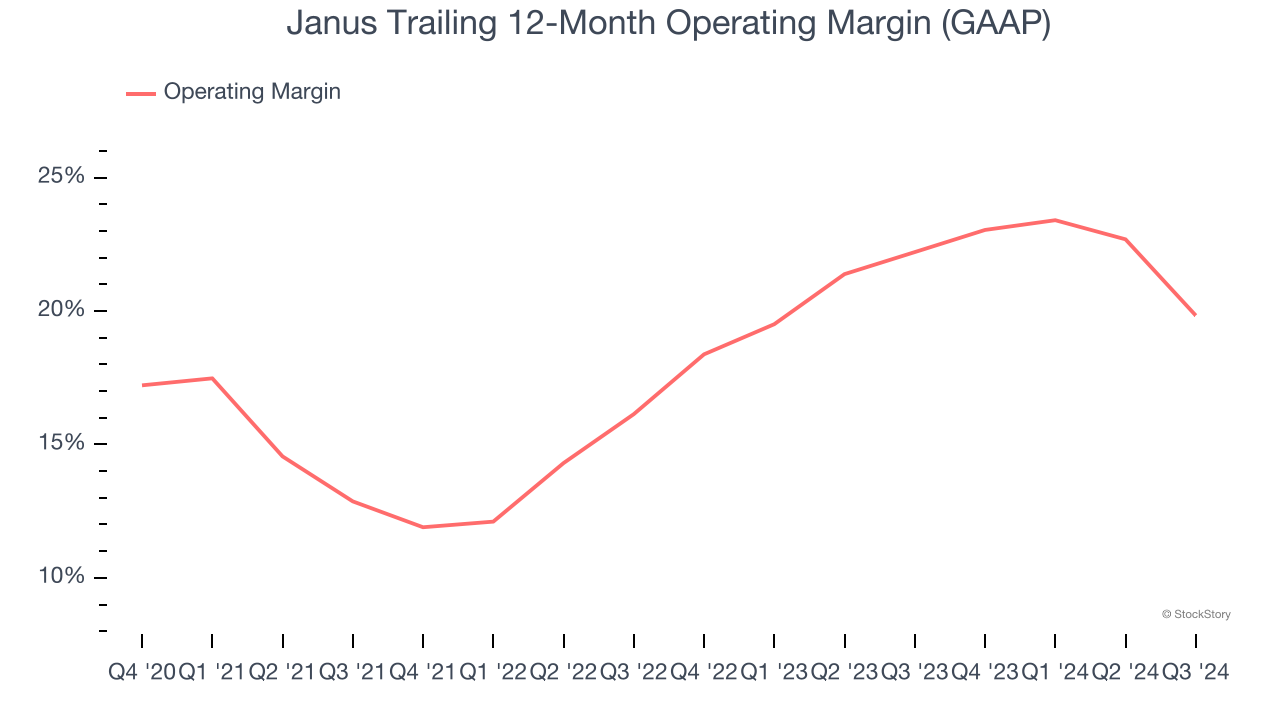

Janus has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Janus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

Earnings Per Share

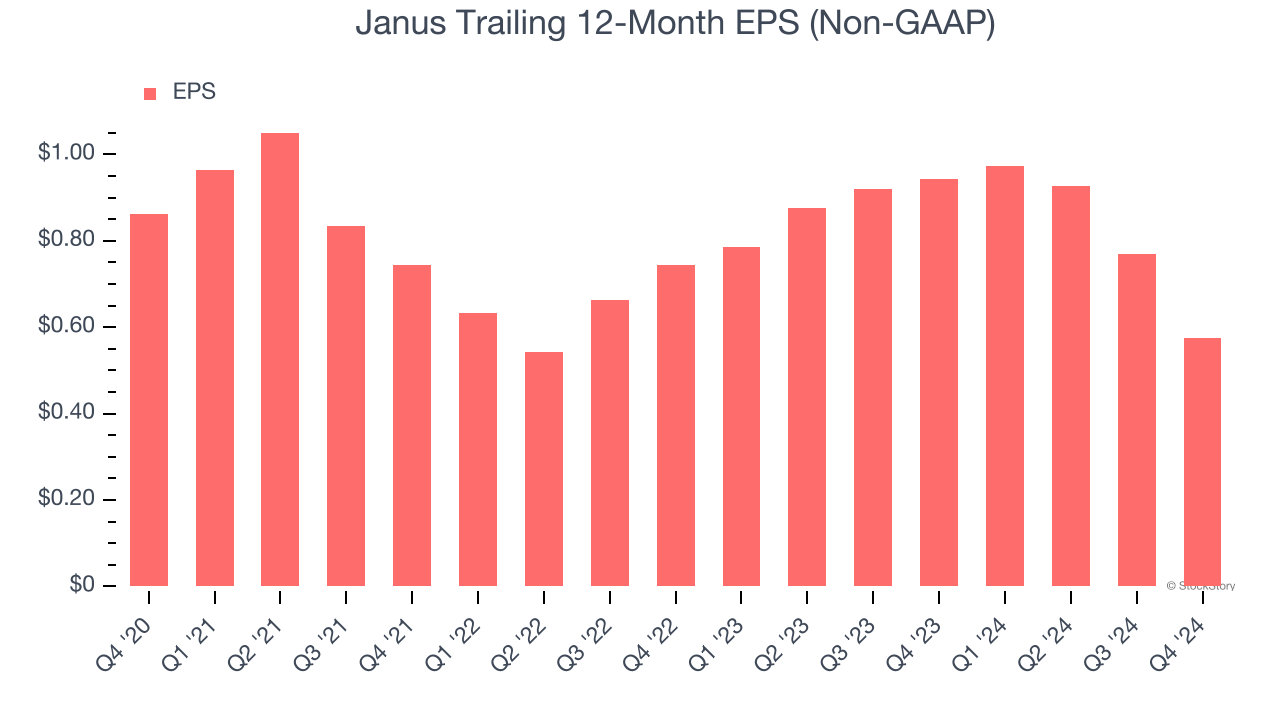

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Janus, its EPS declined by 9.6% annually over the last four years while its revenue grew by 15.1%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Janus, its two-year annual EPS declines of 12% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Janus reported EPS at $0.05, down from $0.24 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Janus to perform poorly. Analysts forecast its full-year EPS of $0.58 will hit $0.38.

Key Takeaways from Janus’s Q4 Results

We were impressed by how significantly Janus blew past analysts’ revenue, EBITDA, and EPS expectations this quarter. Looking ahead, full-year revenue and EBITDA guidance also beat Wall Street's estimates. The stock traded up 12.8% to $9.08 immediately after reporting.

Sure, Janus had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.