Over the past six months, Bentley’s shares (currently trading at $47.62) have posted a disappointing 5.3% loss, well below the S&P 500’s 10.4% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy BSY? Find out in our full research report, it’s free.

Why Does Bentley Spark Debate?

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ: BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Two Things to Like:

1. Strong Retention Supports Growth and Profitability

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

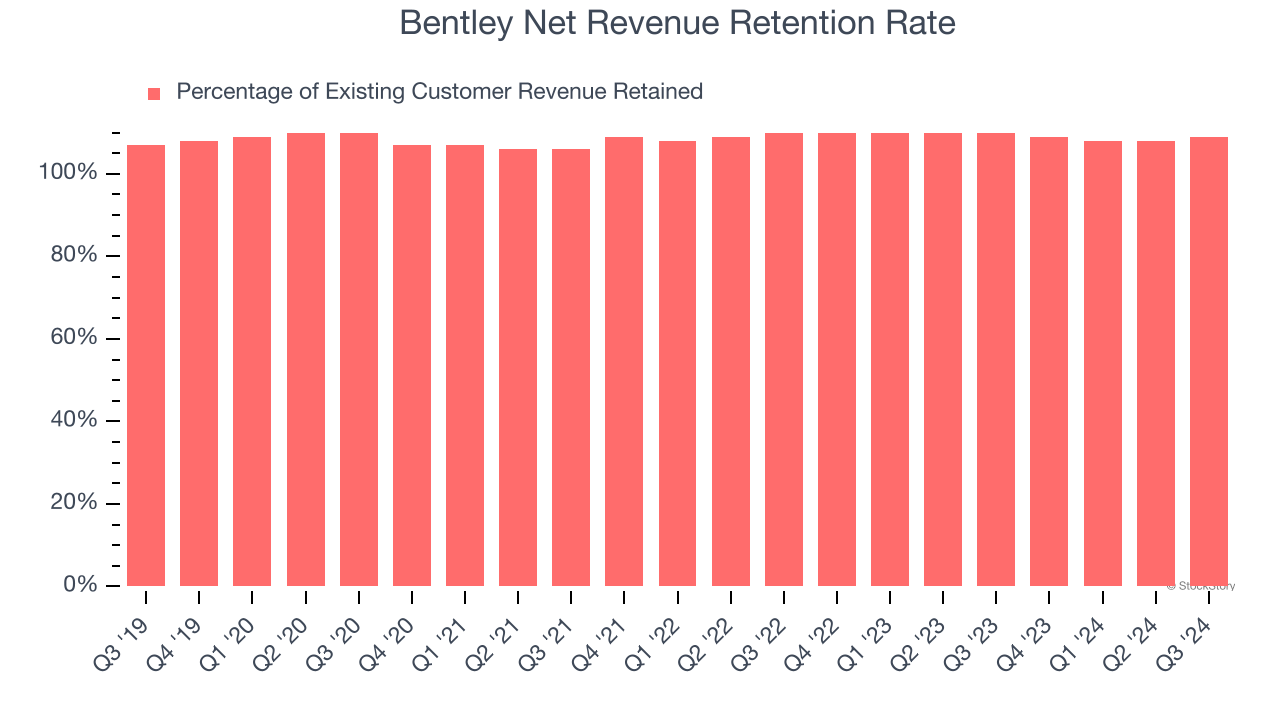

Bentley’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q3. This means Bentley would’ve grown its revenue by 8.5% even if it didn’t win any new customers over the last 12 months.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

2. Operating Margin Reveals a Well-Run Organization

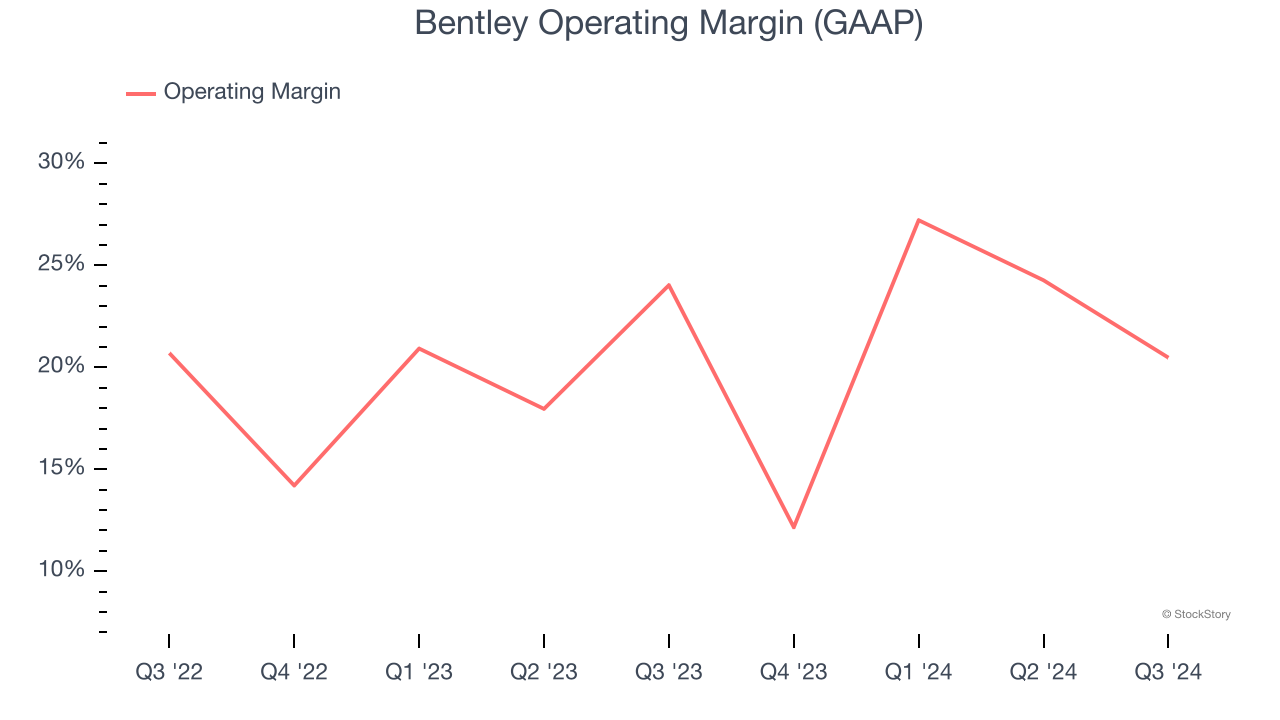

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Bentley has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 21.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Weak Billings Point to Soft Demand

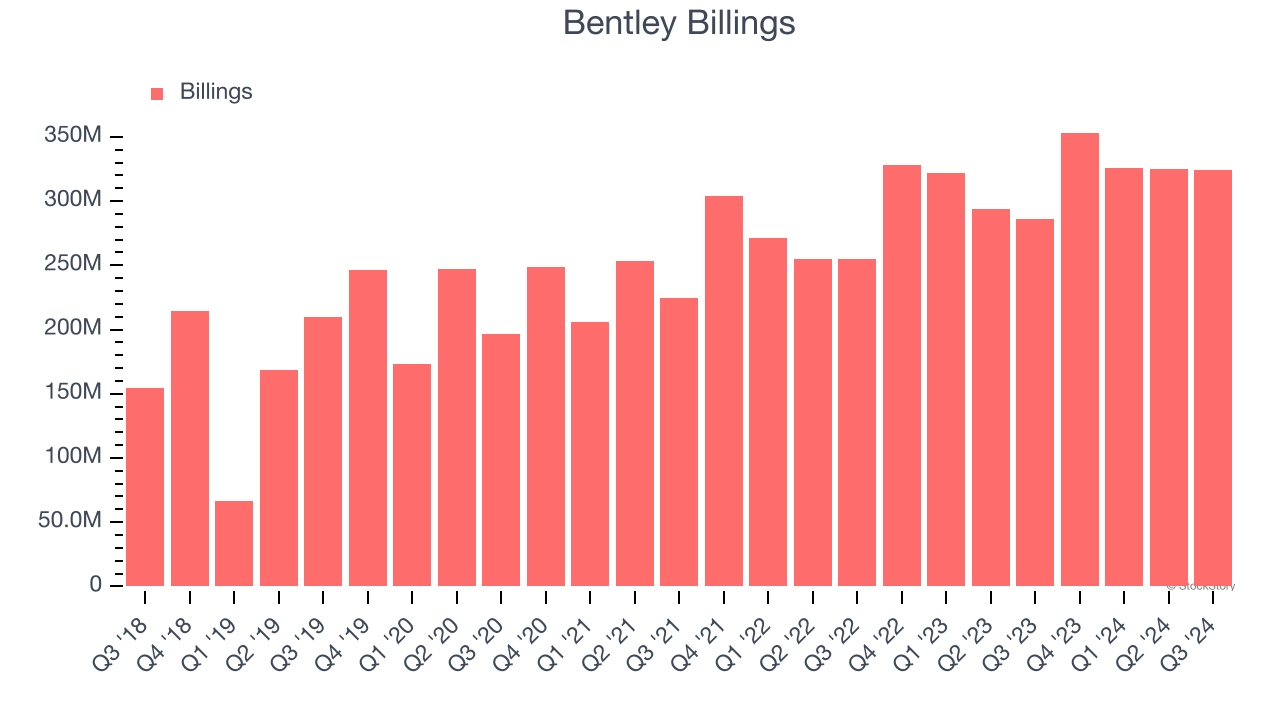

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Bentley’s billings came in at $324.4 million in Q3, and over the last four quarters, its year-on-year growth averaged 8.2%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Bentley has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 10.9× forward price-to-sales (or $47.62 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Bentley

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.