Advertising software maker The Trade Desk (NASDAQ: TTD) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 27.3% year on year to $628 million. The company expects next quarter’s revenue to be around $756 million, close to analysts’ estimates. Its non-GAAP profit of $0.41 per share was also 4% above analysts’ consensus estimates.

Is now the time to buy The Trade Desk? Find out by accessing our full research report, it’s free.

The Trade Desk (TTD) Q3 CY2024 Highlights:

- Revenue: $628 million vs analyst estimates of $620.5 million (1.2% beat)

- Adjusted EPS: $0.41 vs analyst estimates of $0.39 (4% beat)

- EBITDA: $257 million vs analyst estimates of $253.4 million (1.4% beat)

- Revenue Guidance for Q4 CY2024 is $756 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 80.5%, in line with the same quarter last year

- Operating Margin: 17.3%, up from 7.6% in the same quarter last year

- EBITDA Margin: 40.9%, in line with the same quarter last year

- Free Cash Flow Margin: 35.4%, up from 9.7% in the previous quarter

- Market Capitalization: $61.56 billion

“The Trade Desk delivered strong performance in the third quarter, with revenue of $628 million, accelerating growth to 27%. This performance underlines the value that advertisers are placing on precision and transparency as they work with us to maximize the impact of their campaigns,” said Jeff Green, Co-founder and CEO of The Trade Desk.

Company Overview

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

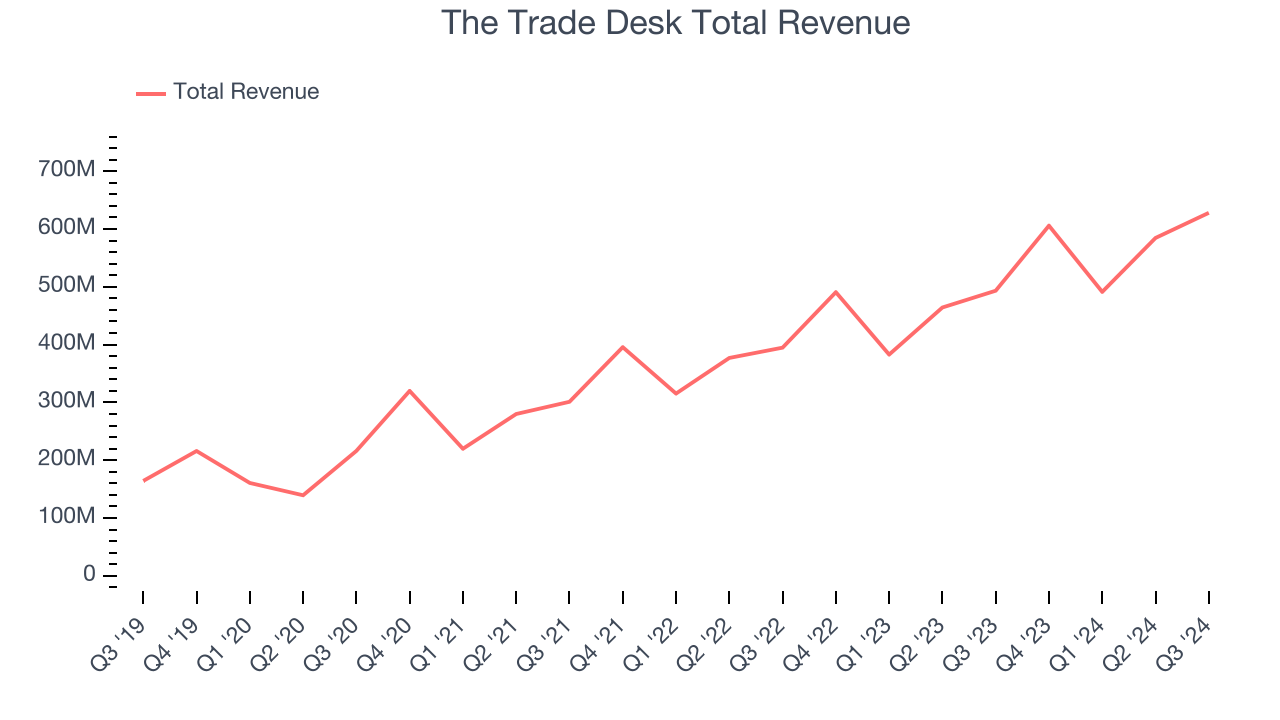

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, The Trade Desk grew its sales at a solid 27.3% compounded annual growth rate. This is encouraging because it shows The Trade Desk was more successful in expanding than most software companies.

This quarter, The Trade Desk reported robust year-on-year revenue growth of 27.3%, and its $628 million of revenue topped Wall Street estimates by 1.2%. Management is currently guiding for a 24.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.8% over the next 12 months, a deceleration versus the last three years. This projection is still commendable and indicates the market is baking in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

The Trade Desk is extremely efficient at acquiring new customers, and its CAC payback period checked in at 3.9 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from The Trade Desk’s Q3 Results

It was good to see The Trade Desk beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. But TTD is priced for perfection and exceeding expectations, not in-line results. The stock traded down 7% to $123.30 immediately after reporting.

Is The Trade Desk an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.