SHERIDAN, WY / ACCESS Newswire / June 16, 2025 / Bad credit may sometimes mean a loan will never be forthcoming. A bad credit personal loan might be what someone needs in that case to have funds made available again for ends to meet, or pay some of those overdue medical bills that can't wait. What is a Small Personal Loan for Bad Credit?

Visit Official Site To Learn More

Small personal loans are offered to the person who has low credit scores; the loans allow a person with poor credit to borrow an amount of money that is little and for the short term to overcome urgent financial problems. With bad credit, higher interest rates may be applied.

5 Best Small Personal Loans for Bad Credit

Now Personal Loans - Best Choice for small personal loans

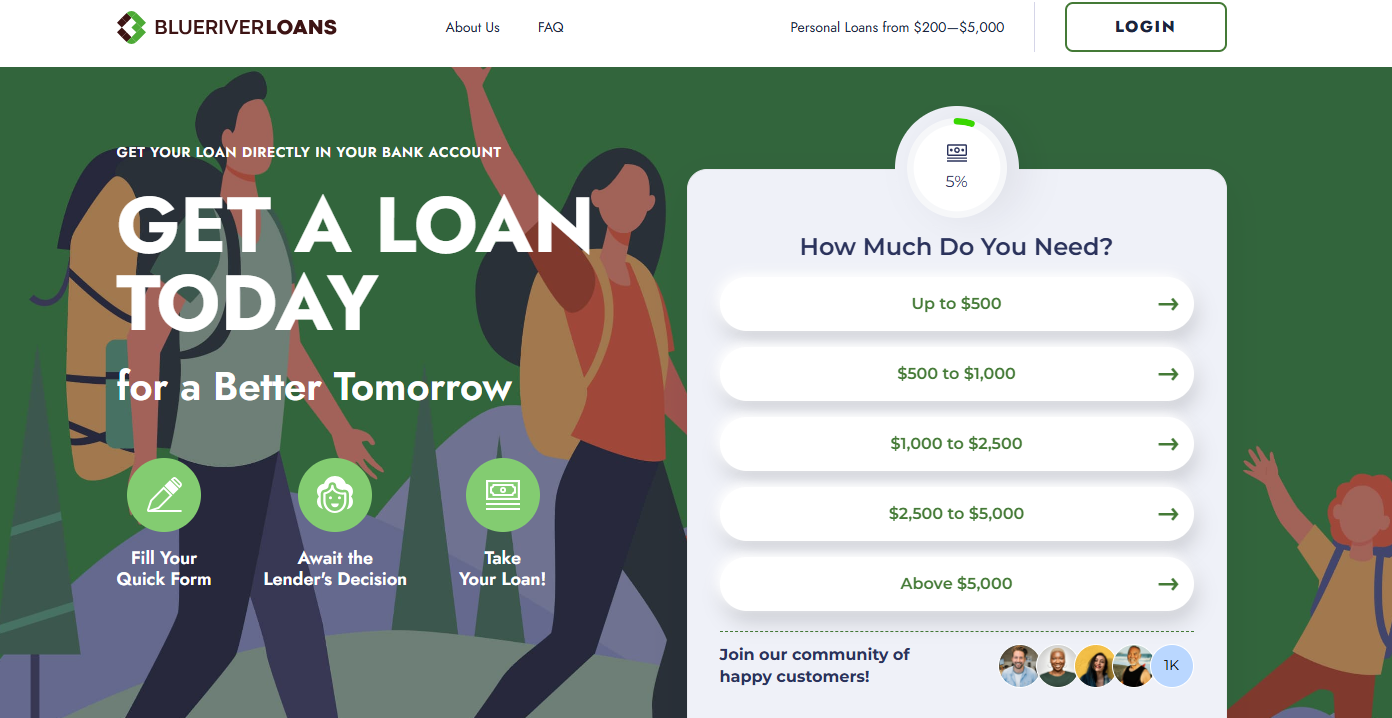

Blue River Loans - Recommended for no credit check loans

Get Cash 4Me - Bad credit personal loans guaranteed approval

Credit Lend - Instant approval payday loans direct lenders

Wizay - choose for the best installment loans bad credit

Major Features of Bad Credit Small Personal Loans

Strict Credit Requirements: These loans usually do not cause much of an issue with one's credit, so low credit and people with bad credit also qualify for such kinds of loans. Lenders place more emphasis on other criteria and factors like your salary or job employment.

Quick approval procedure: In cases where one makes an application for such a loan, it would be reviewed usually within hours; sometimes on the same day. Meaning that the individual will receive money for the needed requirement, which mostly is urgent for expenditure.

Flexible Amount Loans: Small personal loans are offered in various amounts, for example, very small amounts to relatively larger loans. This way, you can only borrow what you require and not borrow more than what you can pay back.

Short Repayment Terms: These loans have very short repayment periods. That is, you will be required to repay the loan within a few weeks to some few months. This enables you to recover from the debt faster. However, ensure you can pay it back within this duration.

Simple Application Process: Most lenders have a very simple, hassle-free online application process. You do not need to provide much documentation or go through a long process to apply for the loan.

Things to Consider Before Getting a Small Personal Loan for Bad Credit

Before deciding to take out a small personal loan for bad credit, here are a few important things you should think about:

Interest rates and fees: Loans with bad credit interest rates are usually higher and, therefore, might force you to pay back more money over time. Be keen on how much interest you will have to pay plus whether there are other side fees you will incur in relation to the total cost of the loan.

Repayment Terms: Look closely at the repayment schedule and ensure the terms are not too hard on you. If you are unsure that you can meet the monthly payments, you may have to pay late fees or even exacerbate the situation by damaging your credit further. Make sure the terms fit your budget.

Lender Reputation: It's crucial to choose a trustworthy lender. Check reviews, research their background, and ensure that they are transparent about their terms. Some lenders may charge hidden fees, so it's best to work with one that has a good reputation and clear policies.

Eligibility Requirements: Eligibility requirements may differ with each lender since some may apply to anyone who can apply. While some may require evidence of income or a steady job, others simply require a valid bank account. Make sure that you fit the criteria set by the lender you are applying for so that you do not waste your time getting an application you will not qualify for.

Alternative Options: Other alternatives should be explored before settling for a loan. One such alternative may include borrowing from friends or family as it could prove cheaper than obtaining a loan. Again, one might qualify for other financial assistance programs. So, one always needs to find out options available before making any commitment for loans.

Best Small Personal Loan Providers for Bad Credit

#1. Blue River Loans - Best for Bad Credit Personal Loans

Blue River Loans provides small personal loans of between $100 and $1,500 with a quick approval process and funding within 24 hours. A hard credit inquiry is not necessary, and it will, therefore, not impact your credit score. The loan comes with high fees, however, and repayment takes place over just 14 to 30 days. It's an application that's quite easy but surely not the most perfect for an applicant looking for a long-term remedy for their debt.

Loan Amounts: $100 to $1,500

Approval Time: Instant decision with funding available within 24 hours

Credit Check: No hard credit inquiry is required

Repayment Terms: 14 to 30 days

Pros:

Fast funding

No impact on credit score

Easy online application

Cons:

Higher fees

Short repayment window

#2. Now Personal Loan - Top Choice for Small Personal Loans

These days, personal loans in the $200-$2,000 range can be approved instantly and funded in 1-2 business days. No credit check is necessary for the loan, therefore your credit score is unaffected. There are only 30 days left on the repayment terms. The application process is simple enough, but once more, the cost of the loan results in higher annual percentage rates and smaller dollar amounts, making it more appropriate for short-term financial needs or emergencies.

Loan Amounts: $200 to $2,000

Approval Time: Instant approval with funds transferred within 1-2 business days

Credit Reporting: No impact on credit score

Repayment Terms: Up to 30 days

Pros:

No credit check

Quick fund disbursement

Simple application process

Cons:

Higher APRs

Limited loan amounts

3. GetCash 4 Me

GetCash 4 Me offers instant same-day loan approvals and funding. The loans are between $100 and $1,000. It has no effect on your credit score and there is no credit check. People looking for quick cash will find it useful because it requires little paperwork and has an easy-to-use web application. However, the loan has high fees and short repayment terms, between 14 and 45 days, which are not ideal for people looking for cheaper options or longer repayment periods.

Loan Amounts: $100 to $1,000

Approval Time: Same-day approval and funding

Credit Check: No credit inquiry is required

Repayment Terms: 14 to 45 days

Pros:

Same-day funding

No impact on credit score

Minimal documentation

Cons:

High fees

Short repayment terms

4. Credit Lend

Credit Lend provides personal loans of between $200 and $2,500 with quick online approval and no hard credit check. The loan is paid back in 14 to 30 days with clear terms and quick processing. Though it does not require collateral, the loan amount can be limited, and the borrower might be charged higher fees. Credit Lend is a viable option for those in need of a relatively quick, small loan, but the fees might be too much for some people to handle.

Loan Amounts: $200 to $2,500

Approval Time: Quick online approval

Credit Check: No hard credit check is required

Repayment Terms: 14 to 30 days

-

Pros:

Transparent terms

Fast processing

No collateral required

-

Cons:

Limited loan amounts

Higher fees

5. Wizzay

Wizzay provides loans between $500 and $3,000 and offers instant approval and funding to the borrower within 24 hours. There is no credit check and no early repayment charges. This is very helpful in a situation where more time is needed, or flexibility of repayment is required.

The repayment period from Wizzay will be up to 60 days. However, it needs a higher income to qualify and pays a higher rate of interest, meaning it is the best for borrowers in stable financial positions who require larger loans.

Loan Amounts: $500 to $3,000

Approval Time: Instant decision with funding within 24 hours

Credit Check: No credit inquiry is required

Repayment Terms: Up to 60 days

-

Pros:

Flexible loan amounts

No early repayment penalties

No credit check

-

Cons:

Higher income requirements

Higher interest rates

How to Get a Small Personal Loan for Bad Credit

Step 1: Understand Your Finances

Before you apply for a loan, take a good look at your finances. Check how much money you earn and how much you spend each month. This will help you figure out how much you can afford to borrow and, more importantly, how much you can comfortably repay without putting yourself in financial trouble.

Step 2: Look for Lenders

Not all lenders are the same, so it's important to find one that's reliable. Look for lenders who are well-reviewed and offer clear loan terms. Make sure they explain all fees, interest rates, and repayment schedules upfront.

Step 3: Prepare Your Documents

To apply for a loan, you will need some basic documents. Gather things like:

A valid ID to prove your identity

Proof of your income (such as pay stubs or bank statements)

Your bank details Having these ready will make the application process smoother.

Step 4: Apply for the Loan

Once you've found a lender and gathered your documents, you can apply online. Fill out the loan application with all the correct information. After you submit, wait for the lender to review your application and decide whether to approve your loan.

Step 5: Make a Repayment Plan

If your loan is approved, the next step is to figure out how you will pay it back. Be sure to plan your repayments carefully so you don't miss any deadlines. Missing payments can hurt your credit even more. Try to stick to your plan to avoid late fees and maintain your financial stability.

Tips to Improve Your Approval Chances

Provide Accurate Information: Double-check that all the details you provide on your loan application are correct. Lenders will reject your application if the information doesn't match up.

Show You Have a Stable Income: It is important for lenders to know that you have a reliable source of income, such as a steady job. This proves you can make your loan payments on schedule.

Borrow Only What You Need: It might be tempting to ask for more money than you really need, but it's smarter to only borrow what you can comfortably pay back. Borrowing too much could hurt you financially later.

Compare Different Lenders: Do not settle for the first lender that you come across. Take your time to compare several lenders and settle on the best interest rates, repayment terms, and fees that will help you save money on loans.

Conclusion

Small personal loans for bad credit are fast financial relief, but the choice of lender and terms of the loan are critical in avoiding financial pitfalls. The best providers are Viva Loan, Now Personal Loan, GetCash 4 Me, Credit Lend, and Wizzay, all offering solutions to those with bad credit.

FAQs

Are small personal loans for bad credit safe?

Yes, if borrowed from reputable lenders with transparent terms.

Can I apply without a job?

Some lenders accept alternative income sources like benefits or pensions.

How fast can I get funds?

Many lenders offer same-day or next-day funding.

What if I can't repay on time?

Late repayments may incur fees; contact your lender for options.

CONTACT:

Project Name: Loans At Last

Registered Office Address: 1095 Sugar View Dr Ste 500 Sheridan, WY 82801

Company Website: https://loansatlast.com/

Email: smith@loansatlast.com

Phone: 307-777-7311

Contact person name: Smith

Contact person email: smith@loansatlast.com

SOURCE: Loans At Last

View the original press release on ACCESS Newswire