Photo From unsplash

Photo From unsplashOriginally Posted On: https://infinigeek.com/your-ultimate-guide-to-e-commerce-payment-options/

If you are running an E-commerce business having the right payment options is essential. Here’s everything you need to know about E-commerce payment methods.

The last step in your sales funnel is the final purchase. It’s the reason you spent hundreds of hours designing your online presence, researching your target customers, and creating the perfect inventory. You painstakingly walk visitors through your entire funnel until clicking that big red “Buy Now” button is all that’s left.

Only it’s not. There’s no button. You forgot to include it on your site.

Fortunately, most folks don’t forget the big red button, but choosing the wrong e-commerce payment options is just as dangerous. If your customers’ preferred payment methods aren’t available, they can’t pay you.

You’re losing sales.

And it’s a mistake you can change with only a few keystrokes. Read on to discover which payment options are right for your online business.

The Present Landscape of E-commerce Purchases How To Make Every Interaction with Customers Special

How To Make Every Interaction with Customers Special Did you know that 86% of customers use credit or debit cards to make their online purchases? That’s great news. So long as you have an SSL certified website that uses a credit card portal, 86% of those customers who hit the big red button will be satisfied.

It’s the other 14% you need to worry about.

And those numbers are shifting rapidly. Digital wallets, like Apple Pay and PayPal, are projected to comprise 47% of online payment transactions by 2022. If you’re not including alternative payment systems, you’ll drop nearly 50% of your sales in the next few years.

Understanding Your E-commerce Payment Options Tips To Make Online Payments Easy and Secure for Customers

Tips To Make Online Payments Easy and Secure for Customers Your need new Payment Options for e-Commerce Website, so where do you turn? To the alternatives, of course. You’ll find the most popular listed below.

PayPal: They have around 300 million active accounts. They’re the most popular alternative to credit or debit cards. If you only choose one alternative, this will be your most profitable bet.

The Many Forms of Digital Payment (And When To Use Each)

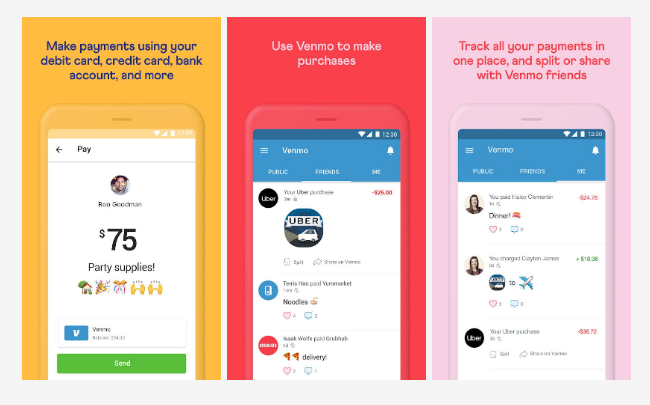

The Many Forms of Digital Payment (And When To Use Each) Venmo: Surprisingly, it’s a subsidiary of PayPal. Unlike its big brother, Venmo makes it absurdly simple to send money to friends as well. It all comes on an app that your clients can install on their phones.

PayPal vs. Google Pay vs. Venmo vs. Cash App vs. Apple Pay Cash

PayPal vs. Google Pay vs. Venmo vs. Cash App vs. Apple Pay Cash Stripe: Stripe is a well-rounded alternative. It includes physical hardware that can replace your clunky credit card machine in your physical store. It accepts all major credit cards and most alternative payments.

Economical E-Commerce: Start a Business in 5 Steps and $500

Economical E-Commerce: Start a Business in 5 Steps and $500 Apple Pay: This is one of the safest payment methods for your customers. It also eliminates your customers’ need to fill out credit card information, speeding up the buying process.

Important Tools You Need When Starting an E-commerce Business

Important Tools You Need When Starting an E-commerce Business Google Pay: It works much the same as Apple Pay. It speeds up your customers’ check out procedure. But unlike Apple Pay, Google Pay integrates well with most platforms and devices.

Wallet Apps Decoded: 5 Secure & Simple Options What’s Next?

Wallet Apps Decoded: 5 Secure & Simple Options What’s Next?

Now that you know the most popular alternative e-commerce payment options, it’s time to get to work. We recommend you include all of them on your site for a month. Afterward, look at your financial statement to gauge which methods are effective and ditch the losers.

If you found this article helpful, skip over to our grand library full of tech, geek, science, and entertainment pieces.