Medical Image Management Market By Product (PACS (Radiology, Mammography, Cardiology, Oncology, Enterprise), VNA, AICA, Universal Viewer), Delivery (On Premise, Hybrid, Cloud), End User (Hospitals, Diagnostic Imaging Center, ASC) - Global Forecast to 2024

Pune, India - January 13, 2020 /MarketersMedia/ —

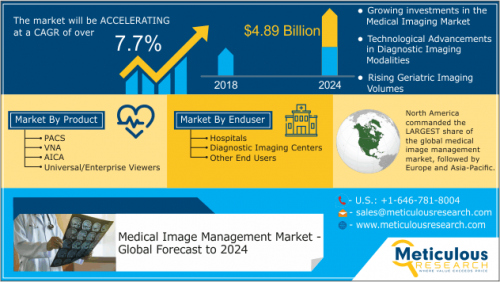

According to this latest publication from Meticulous Research®, medical image management market is expected to grow at a CAGR of 7.7% from 2018 to reach $4.89 billion by 2024, driven by growing investments in the medical imaging market, technological advancements, and rising geriatric imaging volumes. This growth is also supported by growing adoption of VNA and other advanced tools, rapidly growing big data in healthcare, rising focus on value-based care, and growing health IT and EHR adoption. However, longer product lifecycle of VNA, and budgetary constraints may hinder the growth of medical image management market to some extent. In addition, integration of PACS/VNA with EMR, penetration of artificial intelligence in medical imaging, rapidly growing field of telehealth, growing adoption of hybrid and cloud-based solutions, and untapped emerging markets present high-growth opportunities for players operating in the global medical image management market.

Based on product type, PACS commanded the largest share of medical image management market, owing to significant adoption of PACS in radiology department where majority of the imaging studies are handled, managed, and stored; and rising incorporation of PACS into other specialties such as cardiology, ophthalmology, oncology, endoscopy, teleradiology, dermatology, pathology, neurology, and dentistry.

Browse 227 Market Data Tables and 59 Figures spread through 231 Pages and in-depth TOC: https://www.meticulousresearch.com/product/medical-image-management-market/

Based on delivery mode, on-premise PACS captured a major market share owing to the perception of healthcare systems that it provides greater security, control over images and lower latency than cloud storage. However, web/cloud based PACS models are rapidly gaining traction owing to its flexibility of working from remote areas, easy scalability, no upfront costs and reduced operational costs, and automated updating features of web and cloud-based solutions.

Enterprise VNAs dominated the global VNA market in 2017. Multi-departmental VNAs showcase significant adoption while multi-site VNAs are expected to witness stable growth. Factors such as growing emphasis on collaborative care, patient-centered approach and industry consolidation; move towards enterprise imaging; and the ability of VNA to share data among multiple PACS within the same organization and allow organizations to integrate the viewing and storage of different health IT systems regardless of vendor restrictions makes enterprise VNA a preferred option for several large healthcare organizations.

The AICA market is currently led by big VNA companies offering AICA as an advancement to their imaging portfolio to leverage growth opportunities offered by this segment and are also expected to witness highest growth during the forecast period.

For Further Queries on Medical Image Management Market, Visit: https://www.meticulousresearch.com/enquire-before-buying/cp_id=4761

Hospitals are the leading adopters of medical image management systems and are also expected to witness the fastest CAGR during the forecast period, owing to significant population treated in hospitals; growing number of hospitals especially in developing countries; and greater budget to implement advanced solutions such as VNA, AICA and enterprise/universal viewers in hospitals.

This research report analyzes major geographies and provides comprehensive analysis of North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and RoE), Asia-Pacific (Japan, China, India, and RoAPAC), Latin America, and the Middle East & Africa. North America commanded the largest share of the medical image management market in 2017, followed by Europe and Asia-Pacific.

The major players operating in the medical image management market are Agfa HealthCare, BridgeHead Software Limited, Carestream Health, Inc., FUJIFILM Medical Systems U.S.A., GE Healthcare, Hyland Software, Inc., Merge Healthcare Inc. (IBM Corporation), Mach7 Technologies, McKesson Corporation (Change Healthcare), Novarad Corporation, Koninklijke Philips N.V., and Siemens Healthineers, Sectra AB, INFINITT Healthcare CO., among several others.

Purchase this Report at: https://www.meticulousresearch.com/buy_now.php?pformat=12&vformat=29

Key Topics Covered in This Report:

1. Introduction

1.1. Market Definition

1.2. Currency and Limitations

1.2.1. Currency

1.2.2. Limitations

1.3. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.1.1. Secondary Research

2.1.2. Primary Research

3. Executive Summary

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Growing investments in the Medical Imaging Market

4.2.2. Technological Advancements in Diagnostic Imaging Modalities

4.2.3. Rising Geriatric Imaging Volumes

4.2.4. Growing Demand for Imaging Equipment

4.2.5. Rapidly growing Big Data in Healthcare

4.2.6. Growing Health IT and EHR Adoption

4.3. Restraints

4.3.1. Longer Product Lifecycle of VNAs

4.3.2. Budgetary Constraints

4.4. Opportunities

4.4.1. Integration of PACS/VNA with EMR

4.4.2. Untapped Emerging Markets

4.4.3. Penetration of Artificial Intelligence (AI) in Medical Imaging

4.4.4. Hybrid & Cloud-Based Solutions Represent High-Growth Opportunities

4.4.5. Rapidly Growing Field of Telehealth

4.5. Challenges

4.5.1. Data Migration

4.5.2. Lack of Interoperability

5. Medical Image Management Market, by Product

5.1. Introduction

5.2. Picture Archive Communication System (PACS)

5.2.1. PACS Market, by Procurement Model

5.2.1.1. Departmental PACS

5.2.1.1.1. Radiology PACS

5.2.1.1.2. Cardiology PACS

5.2.1.1.3. Others

5.2.1.2. Enterprise PACS

5.2.2. PACS Market, by Delivery Model

5.2.2.1. On-Premise PACS

5.2.2.2. Web/Cloud-Based PACS

5.3. Vendor Neutral Archive (VNA)

5.3.1. VNA Market, by Delivery Model

5.3.1.1. On-Premise VNA

5.3.1.2. Hybrid VNA

5.3.1.3. Fully Cloud-Based VNA

5.3.2. VNA Market, by Procurement Model

5.3.2.1. Enterprise VNA

5.3.2.1.1. Multi-Departmental VNA

5.3.2.1.2. Multi-Site VNA

5.3.2.2. Departmental VNA

5.3.3. VNA Market, by Vendor Type

5.3.3.1. PACS Vendors

5.3.3.2. Independent Software Vendors

5.3.3.3. Infrastructure Vendors

5.4. Application-independent Clinical Archives (AICA)

5.4.1. Application-independent Clinical Archives Market, by Vendor Type

5.4.1.1. VNA Vendors

5.4.1.2. Native AICA Vendors

5.5. Enterprise Viewers/Universal Viewers

6. Medical Image Management Market, by End User

6.1. Introduction

6.2. Hospitals

6.3. Diagnostic Imaging Centers

6.4. Others

7. Medical Image Management Market, by Geography

7.1. Introduction

7.2. North America

7.2.1. U.S.

7.2.2. Canada

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. U.K.

7.3.4. Italy

7.3.5. Spain

7.3.6. RoE

7.4. Asia-Pacific

7.4.1. Japan

7.4.2. China

7.4.3. India

7.4.4. Rest of Asia-Pacific (RoAPAC)

7.5. Rest of the World (RoW)

7.5.1. Latin America

7.5.2. Middle East & Africa

8. Competitive Landscape

8.1. Competitive Benchmarking

8.2. Market Share Analysis

9. Company Profiles

9.1. Agfa-Gevaert Group

9.1.1. Business Overview

9.1.2. Financial Overview

9.1.3. Product Portfolio

9.1.4. Strategic Developments

9.2. Bridgehead Software Ltd.

9.2.1. Business Overview

9.2.2. Financial Overview

9.2.3. Product Portfolio

9.2.4. Strategic Developments

9.3. Carestream Health, Inc.

9.3.1. Business Overview

9.3.2. Financial Overview

9.3.3. Product Portfolio

9.3.4. Strategic Developments

9.4. FUJIFILM Medical Systems U.S.A., Inc.

9.4.1. Business Overview

9.4.2. Financial Overview

9.4.3. Product Portfolio

9.4.4. Strategic Developments

9.5. GE Healthcare

9.5.1. Business Overview

9.5.2. Financial Overview

9.5.3. Product Portfolio

9.5.4. Strategic Developments

9.6. Hyland Software, Inc.

9.6.1. Business Overview

9.6.2. Financial Overview

9.6.3. Product Portfolio

9.6.4. Strategic Developments

9.7. INFINITT Healthcare Co., Ltd.

9.7.1. Business Overview

9.7.2. Financial Overview

9.7.3. Product Portfolio

9.7.4. Strategic Developments

9.8. Merge Healthcare Inc. (An IBM Company)

9.8.1. Business Overview

9.8.2. Financial Overview

9.8.3. Product Portfolio

9.8.4. Strategic Developments

9.9. Mach7 Technologies

9.9.1. Business Overview

9.9.2. Financial Overview

9.9.3. Product Portfolio

9.9.4. Strategic Developments

9.10. McKesson Corporation (Change Healthcare)

9.10.1. Business Overview

9.10.2. Financial Overview

9.10.3. Product Portfolio

9.10.4. Strategic Developments

9.11. Novarad Corporation

9.11.1. Business Overview

9.11.2. Financial Overview

9.11.3. Product Portfolio

9.11.4. Strategic Developments

9.12. Philips Healthcare

9.12.1. Business Overview

9.12.2. Financial Overview

9.12.3. Product Portfolio

9.12.4. Strategic Developments

9.13. Siemens Healthineers

9.13.1. Business Overview

9.13.2. Financial Overview

9.13.3. Product Portfolio

9.13.4. Strategic Developments

9.14. Sectra AB

9.14.1. Business Overview

9.14.2. Financial Overview

9.14.3. Product Portfolio

9.14.4. Strategic Developments

10. Appendix

10.1. Questionnaire

10.2. Available Customizations

Download free sample report and gain crucial industry insights: https://www.meticulousresearch.com/download-sample-report/?cp_id=4761

Contact Info:

Name: Khushal

Email: Send Email

Organization: Meticulous Market Research Pvt. Ltd

Address: Pune, India

Phone: +91-744-7780008

Website: https://www.meticulousresearch.com/product/medical-image-management-market/

Source: MarketersMedia

Release ID: 88942565