BOSTON - November 19, 2019 - (Newswire.com)

Researchers tracking the economic security of America’s older adults have found that half who live alone and nearly a quarter of those living in two-person households where both are age 65 or older are unable to afford basic necessities without extra assistance. The 2019 Elder IndexTM and a companion report, Insecurity in the States 2019, calculates the elder economic “insecurity rate” both nationally and on a state-by-state basis. The new index data and report were produced by the Gerontology Institute at the UMass Boston’s McCormack Graduate School.

Among the states, Massachusetts leads the nation with the highest level of economic insecurity for older adults living alone. Seven of the top 10 states in that economic insecurity category, including New York and New Jersey, were located in the Northeast. They’re joined by Mississippi, Louisiana, and California.

The index estimates the cost to adults age 65 and older for food, housing, healthcare, and transportation in every county in the U.S. Researchers match income data with index results to determine state and national rates of elder economic insecurity.

On average across the country, 18.2 percent of older adults living alone have income below the Federal Poverty Level. Another 32.1 percent live “in the gap,” with income that exceeds the poverty line but falls short of covering their actual cost of living.

“Making ends meet is a daily challenge for many older adults, especially those who live alone,” said Jan Mutchler, director of the Gerontology Institute’s Center for Social and Demographic Research on Aging. “The elder index provides an important reality check – a realistic measure of the actual cost of a no-frills lifestyle for elders living independently.”

Findings include:

* National averages suggest 50 percent of older adults living alone and 23 percent of elder couples have annual incomes below the Elder Index.

* Nationwide, 32 percent of single elders and 18 percent of couples fall into the gap between the Federal Poverty Level and the income required for realistic economic security.

* At least 40 percent of elder adults in every state are at-risk of being unable to afford basic needs and age in their own homes.

* More than half of older adults living below the Elder Index rely on Social Security for at least 90 percent of their incomes.

The elder index calculated a realistic national average annual cost of living of $25,416 for renting elder singles and $36,204 for elder couples.

Overall, the state with the lowest Elder Economic Insecurity Rate was Nevada, followed by Alaska and Utah. See complete state rankings.

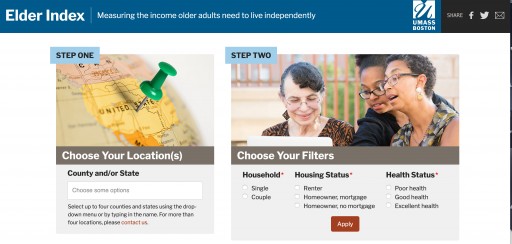

The Elder Index is a free online resource available for anyone to look up customized information about the cost of elder living in any county, state, or the country. It can be found at a new location: www.elderindex.org.

Contact:

Steven Syre

(617) 365-0116

steven.syre@umb.edu

Related Links

UMass Boston Gerontology Institute

Elder Index

Related Files

Living Below the Line_ Economic Insecurity and Older Americans I.pdf

Press Release Service by Newswire.com

Original Source: Half of Single Older Adults in U.S. Lack Income to Pay for Basic Needs