( click to enlarge )

( click to enlarge )FORM Holdings Corp. (NASDAQ:FH) has been on fire since the start of September and looks ready to make another upside move. The stock broke out of a consolidation range as the stock closed up 45c on the day. Friday’s high was $3.55 which is resistance for Monday’s continuation move. As long as the stock stays above the EMA200, the bullish scenario is still intact. Technical daily chart shows bullish signs with A/D line rising and MACD on top of signal line. I alerted this one several times last month after have detected unusual insider acitvity. I still holding my long position. My stop-loss was adjusted to 2.92 (rising EMA20).

( click to enlarge )

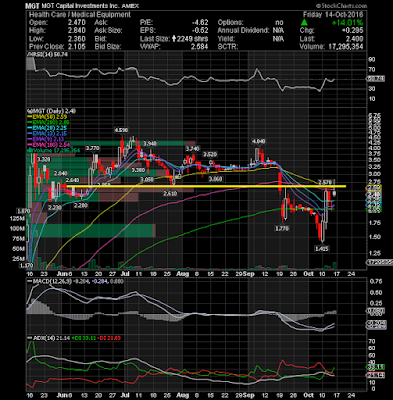

( click to enlarge )MGT Capital Investments Inc. (NYSEMKT:MGT) Great run last week on stronger above average volume. Next week the stock needs a close over the horizontal resistance line around the 2.62 level to turn chart bullish on a breakout to the upside. Getting above and staying above this key level would be bullish for the stock and should lead to further upside momentum going forward. On watch.

( click to enlarge )

( click to enlarge )Yirendai Ltd (NYSE:YRD) Broke out on Friday on decent volume. Excellent relative strength to broad market. Let's see if next week the stock will confirm the breakout. On the technical side, chart looks Bullish with all major EMAs going up and MACD on top of 0, RSI in a Bullish area too.

( click to enlarge )

( click to enlarge )Tokai Pharmaceuticals Inc (NASDAQ:TKAI) I use arguments based on charts to determine my view on a security, and all factors about TKAI were mentioned on Saturday's blog post. As long as the accumulation/distribution line stays in an upward direction, my bias is bullish. The accumulation / distribution line is often considered a leading indicator, because it shows when a stock is being accumulated or distributed, foreshadowing major price moves. For that reason, i will not change my view unless it breaks and closes below the 1.40 support level. Short-term EMAs also support the bullish bias, all are rising. Only time will tell if I was right.

( click to enlarge )

( click to enlarge )CSX Corporation (NASDAQ:CSX) tried to break out on Friday but the weak market pulled the stock down from its high. The stock hit a high of $31.73 which is now resistance for Monday’s follow through move. Although this uptrend is encouraging, the near-term outlook stays cautious till the stock closes conclusively above the 31.50 level on heavy volume. Bulls could remain invested with a stop loss on its rising EMA20.

( click to enlarge )

( click to enlarge )Resolute Energy Corp (NYSE:REN) recorded a new all-time high on Friday as it broke over $31.05. It continues to show impressive strength. The stock hit a high of $33.10, which is now resistance for Monday’s continuation move. The pivot points on the hourly chart above can be used to determine good points to buy or sell.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC