MP Materials (MP) has rapidly moved from an overlooked rare-earth producer to a central player in U.S. industrial strategy. As the United States works to reduce its reliance on China for critical technology inputs, MP’s role in rebuilding a domestic rare-earth supply chain has become impossible for Wall Street to dismiss.

The shift in recognition was evident on Nov. 19, when MP stock rallied nearly 9% after Goldman Sachs analyst Brian Lee initiated coverage with a "Buy" rating. Lee noted that MP Materials remains the largest producer of rare earth materials in the Western Hemisphere, with production concentrated in neodymium-praseodymium oxide (NdPr).

The compound is essential for permanent neodymium (NdFeB) magnets that power everything from consumer electronics to electric vehicles (EVs) and complex defense systems. As the company completes the shift from raw material extraction to full-scale magnet manufacturing, Goldman Sachs anticipates robust revenue and EBITDA growth, unlocking significant margin leverage.

At the time of the call, the analyst firm's 12-month price target of $77 for MP stock indicated a nearly 32% potential increase. Since then, though, the stock has crossed the $70 mark before retreating back to around $58, raising the question of whether MP stock still has more to run.

About MP Materials Stock

Headquartered in Las Vegas, Nevada, MP Materials is one of the United States' leading producers of rare earth materials. Its flagship asset — the Mountain Pass mine in California — remains the only active rare earth mine in North America.

With a market capitalization of more than $10.2 billion, MP's management has taken its operations far beyond extraction. It now produces metals and alloys and refines isolated oxides, lowering its reliance on foreign sources at a time when clean energy capacity and national security concerns are growing.

Shares of MP stock have risen 155% in the last 52 weeks and 16% year-to-date (YTD). The stock has significantly outpaced the broader S&P 500 Index ($SPX), which has reported a 12% gain for the past year and remained flat YTD.

MP trades at 155 times forward sales, which more than exceeds the industry average. This premium may demonstrate investor confidence in the company's long-term advantage as demand for a reliable local supply of rare earth elements is growing.

A Closer Look at MP Materials’ Q3 Earnings

MP Materials reported its third-quarter fiscal 2025 earnings results after markets closed on Nov. 6, and the shares rose nearly 13% the next day. The company reported revenue of $53.6 million, falling short of analyst projections of $54.9 million. Total sales fell 15% year-over-year (YOY) as the company stopped selling products to China to comply with the requirements of its agreement with the Department of War (formerly the Department of Defense).

Net loss widened 64% to $41.8 million as decreased revenue and higher project development expenses weighed on profitability. Meanwhile, loss per share widened 50% from the previous year’s quarter to $0.24, missing the estimated loss of $0.19 per share.

Despite these challenges, operational strength demonstrated significant progress. MP Materials produced 721 metric tons of NdPr oxide, a 51% increase over the previous year. At 13,254 metric tons, MP also reported its second-best quarterly REO output. The quarter concluded with $1.9 billion in cash, cash equivalents, and short-term investments.

With the completion of significant parts of its government agreements, MP appears to be entering a phase of improved cash flow visibility. The funding would accelerate the company's magnet manufacturing expansion, including the first commercial output from Independence before the end of the year.

That said, analysts estimate Q4 EPS to increase by 114% YOY to $0.02. They also predict MP's fiscal 2025 loss per share to narrow 29% from the prior year to 0.41. Moreover, fiscal 2026 is expected to see EPS growth of 183% YOY to $0.34.

What Do Analysts Expect for MP Materials Stock?

Similar to Goldman Sachs, DA Davidson has an optimistic view of the stock. Analyst Matt Summerville recently retained a “Buy” rating with an $82 price target. DA Davidson sees significant value in the company's vertically integrated strategy and expanding role in procuring vital minerals for U.S. supply chains.

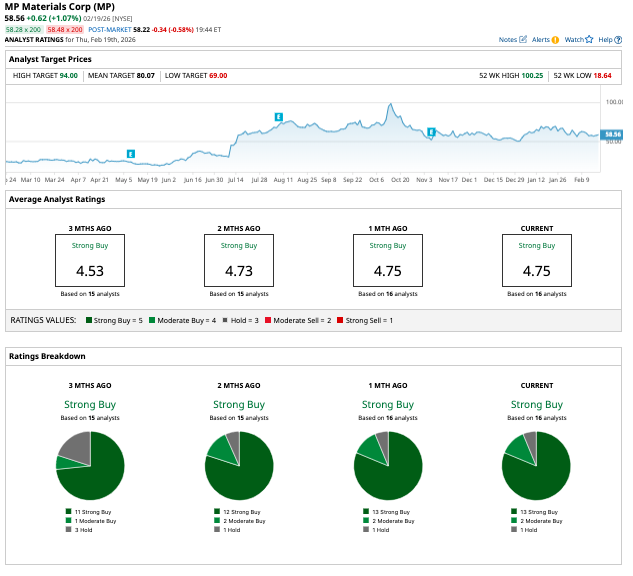

Analysts remain overwhelmingly positive on MP stock, assigning an overall rating of “Strong Buy.” Among 16 analysts covering shares, 13 recommend a “Strong Buy,” two recommend a “Moderate Buy,” and one suggests a "Hold" rating.

MP’s average price target of $80.07 represents potential upside of 37%. Meanwhile, the Street-high target of $94 suggests a potential gain of 61% from current levels. The consistency in these projections shows that analysts continue to view MP Materials' growth path as durable.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Says MP Materials Stock Can Gain More Than 30% From Here. Should You Buy MP Stock?

- Gold and Silver Prices Are Calmer, But Not Calm: What to Watch Next

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- Speculators Fell in Love—The Market Didn’t: Silver After Valentine’s Day