With a market cap of $11.3 billion, Gartner, Inc. (IT) is a global research and advisory firm that provides business and technology insights to help organizations make better decisions on mission-critical priorities. It operates through Insights, Conferences, and Consulting segments, offering subscription-based research, executive conferences, and technology-driven strategic consulting worldwide.

Shares of the Stamford, Connecticut-based company have significantly lagged behind the broader market over the past 52 weeks. IT stock has dropped 69.1% over this time frame, while the broader S&P 500 Index ($SPX) has risen 12.1%. Moreover, shares of the company have decreased 38.4% on a YTD basis, compared to SPX's marginal gain.

Looking more closely, shares of the technology information and analysis company have underperformed the State Street Technology Select Sector SPDR ETF's (XLK) 16.2% increase over the past 52 weeks.

Shares of Gartner tumbled 20.9% on Feb. 3 as Q4 2025 net income fell 39% year-over-year to $242 million and EPS dipped 34% to $3.36. Full-year 2025 results deepened concerns, as net income declined 42% to $700 million and EPS fell 40% to $9.65. The sell-off was compounded by deteriorating cash generation, with operating cash flow down 13% to $1.3 billion and free cash flow falling 15% to $1.2 billion, overshadowing management’s optimistic outlook for 2026.

For the fiscal year ending in December 2026, analysts expect Gartner's EPS to rise 1.5% year-over-year to $13.37. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

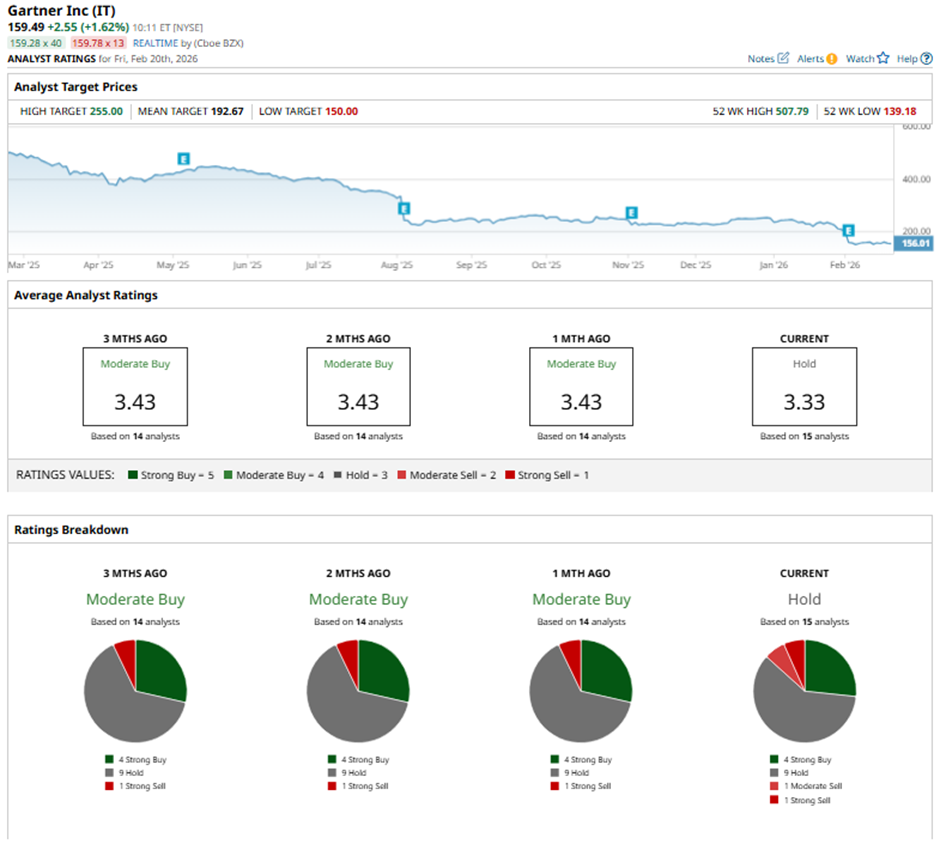

Among the 15 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, nine “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Feb. 6, Truist analyst Jasper Bibb cut the price target on Gartner to $170 while maintaining a “Buy" rating.

The mean price target of $192.67 represents a 20.8% premium to IT’s current price levels. The Street-high price target of $255 suggests a 59.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- David Einhorn Is Buying the Dip in This Penny Stock: Should You Too?

- Opendoor Jumps on iBuying Surge Despite Big Earnings Miss

- This Stock Lets You Collect a Dividend While on Vacation

- You’ll ‘Make More Money When Snoring Than When Active’: Warren Buffett Says Stop Trading Stocks, and You’ll Make More Money with Less Effort