IDEX Corporation (IEX) manufactures specialized fluid and metering solutions, health technologies, firefighting gear, and engineered components. Based in Northbrook, Illinois, it runs numerous businesses worldwide, delivering vital innovations to key industries. The company has a market capitalization of $15.64 billion.

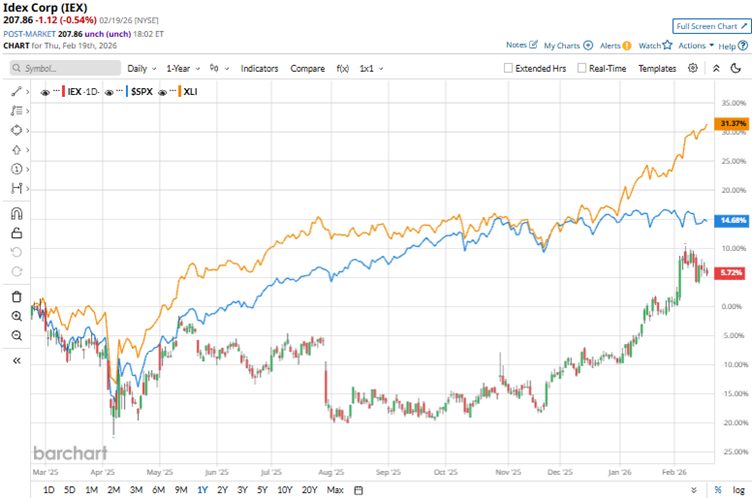

Modest revenue growth amid mixed segment demand and a sluggish macro environment has affected the stock’s trajectory. Over the past 52 weeks, IDEX’s stock has gained 4.6%, while the broader S&P 500 index ($SPX) is up 11.7% over the same period, indicating that the stock has underperformed the broader market.

However, IDEX’s shares are up 16.8% year-to-date (YTD), while the broader index is only up marginally. The stock reached a 52-week high of $217.15 on Feb. 6, but is down 4.3% from that level. Compared with the company’s own sector, we observe the same trend: the State Street Industrial Select Sector SPDR ETF (XLI) has increased 27.1% over the past 52 weeks, while rallying 13.7% YTD.

On Feb. 4, IDEX reported its fourth-quarter results for fiscal 2025, which beat analysts' expectations, driving its stock to a 5.3% intraday gain that day. For Q4, the company’s orders increased by 20% year-over-year (YOY) to $979.20 million, net sales grew 4% to $899.10 million, and adjusted EPS climbed 3% to $2.10. In the Health & Science Technologies (HST) segment, revenue increased 9% YOY, or 5% organically, driven by positive price movements and volume increases across the data center, semiconductor consumables, space, and defense businesses, as well as 8020-driven commercial initiatives.

For the current quarter, Street analysts expect IDEX’s profit to increase 2.3% YOY to $1.79 per diluted share, while for the current year, it is expected to increase 4.2% to $8.28 per diluted share, followed by a 10.5% growth to $9.15 per diluted share in the following year. The company also has a solid history of surpassing consensus estimates, topping them in each of the four trailing quarters.

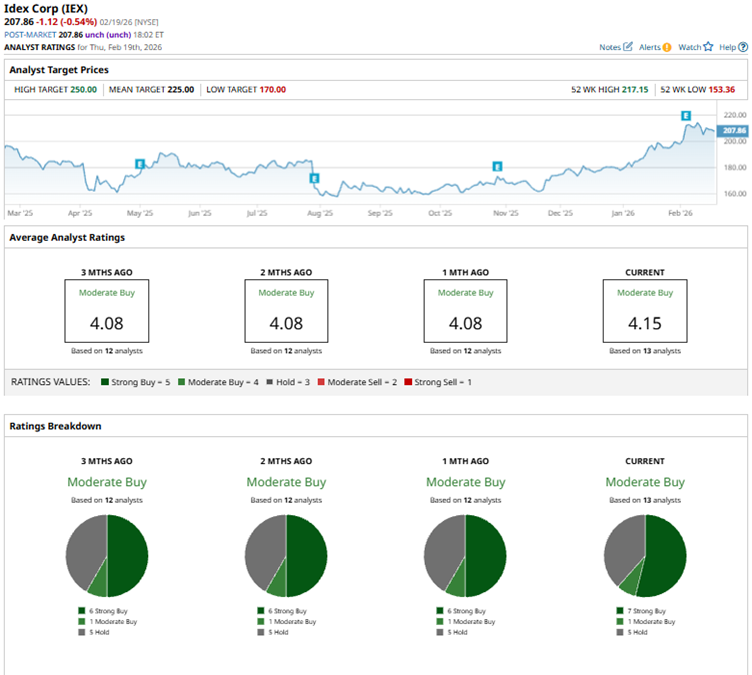

Among the 13 Wall Street analysts covering IDEX’s stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.” The ratings configuration has become more bullish than a month ago, with the number of “Strong Buy” ratings rising from six to seven.

Post the company’s Q4 earnings release, analysts at Argus Research, represented by analyst John Eade, upgraded IDEX’s stock from “Hold” to “Buy,” while setting a new price target of $240. This reflects a bullish outlook on the company’s prospects.

IDEX’s mean price target of $225 indicates an 8.2% upside over current market prices. Moreover, the Street-high price target of $250 implies a potential upside of 20.3%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 24% in 2026, Where Is Palantir Stock Headed Next and Should You Buy PLTR Here?

- As Meta and Nvidia Announce a Huge, Multi-Year Partnership, Which Is the Better Stock to Buy?

- Palo Alto Networks Stock Has Tanked But Its Free Cash Flow is Strong - Time to Buy PANW?

- 1 Analyst Thinks This Stock is The "Godfather of AI"